Natural or synthetic rubber? What the EUDR requires and how to ensure the correct classification

EUDR - Reading time: 8 Min

With the entry into force of the EU regulation on the deforestation-free supply chain (EUDR - European Union Deforestation Regulation), companies along global supply chains are faced with far-reaching obligations. This also brings the correct EUDR classification of rubber products into focus: companies must determine whether their products fall under the requirements of the regulation. Those who trade, produce or process rubber, elastomers or rubber products are particularly affected. The exact classification determines documentation obligations and risks. The distinction between natural rubber (e.g. raw rubber obtained from hevea trees) and synthetic rubber (petrochemically produced polymers) is therefore coming into focus: anyone placing natural rubber or goods made from it on the European market or importing it from December 30, 2025, must comply with strict obligations to provide evidence of origin and sustainability. In the following article, you will find practical instructions on how to make the distinction between natural and synthetic rubber transparent, classify your products in a legally compliant manner and minimize compliance risks in international trade.

The most important facts

The EUDR obliges companies to prove that natural rubber and products made from it are deforestation-free when importing or placing natural rubber on the market.

All products that fall under HS code 4001 are affected, i.e. those that contain natural rubber - for example raw rubber, latex or products with a high natural rubber content. Products made purely from synthetic rubber (HS code 4002), on the other hand, are not covered by the regulation.

The distinction is made on the basis of origin and chemical composition. Natural rubber comes from plant sources, synthetic rubber is produced petrochemically. The decisive factor is which component gives the product its main character and which HS code applies in the customs tariff.

No, the EUDR does not have any fixed threshold values. Even small quantities of natural rubber can be relevant if they determine the essential character of the product.

For correct classification, companies should use the electronic customs tariff (TARIC), the German EZT online system and internal product data such as technical data sheets and supplier information.

The customs tariff number determines whether a product falls under the EUDR. Only products with the HS code 4001 are subject to the obligations of the regulation. Incorrect classification can have legal consequences such as fines or delays in customs clearance.

Companies in the tire industry, medical technology, mechanical engineering, the construction industry and the electronics sector are particularly affected - wherever natural rubber is used as a raw material or component.

Companies should check their entire product portfolio for rubber components, analyze the material composition, determine the applicable HS codes and introduce clear processes for verification.

Executive Summary

With the inclusion of natural rubber in the EU regulation on the deforestation-free supply chain (EUDR), companies along the entire rubber value chain are obliged to fulfill extensive due diligence obligations. The key prerequisite for compliance with these requirements is the correct EUDR classification of products according to the customs tariff: only products based on natural rubber (HS code 4001) are subject to the EUDR - synthetic rubber (HS code 4002) is not affected. For companies, this means that even small quantities of natural rubber may be subject to declaration if they determine the character of the product. Careful examination of the material composition and precise classification in the customs tariff is therefore essential. Mixed products pose a particular challenge - here it is necessary to clarify which ingredient predominates.

This affects not only importers of raw materials, but also manufacturers and traders of semi-finished and finished products, particularly in the tire, medical and construction industries. Companies should use suitable tools such as TARIC or EZT-Online, establish internal processes for classification and verification and work together with customs authorities or specialized consultants at an early stage. Correct classification forms the basis for legally compliant implementation of the EUDR. It helps to avoid compliance risks, make supply chains transparent and secure long-term access to the EU market.

New raw material registration: natural rubber under the EUDR regulation

Background: Extension of the EUDR commodity list

The EUDR is part of the European Union's Green Deal and marks a paradigm shift for companies along global supply chains. Its core requirement: in future, only deforestation-free products and their downstream products may be imported into the EU or placed on the market within the Union. This is intended to curb forest degradation and deforestation. Following the original inclusion of raw materials such as palm oil, soy, wood, coffee, cocoa and cattle derivatives in the list of regulated processes, a further decisive step was taken at the beginning of 2023: Natural rubber was officially included as the seventh raw material in Annex I of the EUDR. With this extension, the EU is responding to studies by various environmental organizations that show that the global cultivation of hevea trees for rubber production contributes significantly to deforestation in Southeast Asia and parts of Africa.

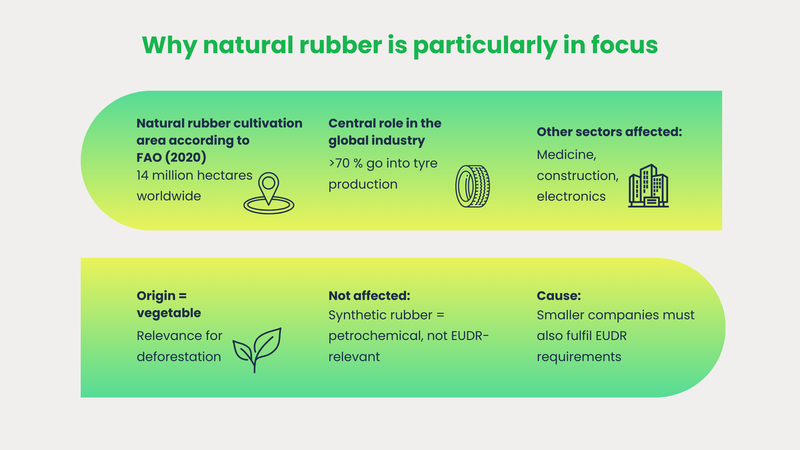

According to current FAO statistics (2020), over 14 million hectares of land worldwide were used for the production of natural rubber, with impacts on biodiversity, local communities and the global climate. The decision to include natural rubber in the EUDR is therefore a strategically important step towards more sustainable and transparent supply chains.

Why natural rubber is particularly relevant

Natural rubber plays an important role in global supply chains. Over 70% of global production is used for the manufacture of vehicle tires. However, many other sectors - such as the medical, construction and electronics industries - also use rubber made from Hevea latex for their products. While products with synthetic rubber are often petrochemically produced and currently do not fall under the EUDR, natural rubber is a particular focus of legislation due to its plant origin and potential deforestation effects and therefore falls under the EUDR classification. The large amount of global trade and processing associated with this raw material means that even small processing companies or importers will have to make compliance efforts in the future.

Significance for companies along the supply chain

Who is affected - from raw material importers to processors

The EUDR applies to all companies that place natural rubber or products made from it on the EU internal market for the first time or import it. This applies not only to multinational tire manufacturers, but also to specialized companies that manufacture medical technology, shoe soles or conveyor belts, for example. Importers of semi-finished goods, suppliers to the automotive industry or distributors of consumer goods are also affected. Both the actual entry into the EU market and any transformation, mixing or customs clearance of the goods are relevant. Of practical relevance is the fact that many products contain mixtures of natural and synthetic rubber. Companies must check the origin of the rubber contained in each individual item of goods and how high its proportion is. This means a considerable amount of work for product documentation, due diligence declarations, geolocalization, supply chain traceability and exchanges with suppliers from third countries.

Relevance of correct classification for compliance and customs

The classification of a product as natural rubber, a mixture or synthetic rubber has far-reaching legal consequences. The correct HS codes (Harmonized System of Customs Classification) must be used for customs clearance. Only goods made of natural rubber (and therefore all products listed under HS code 4001) will be subject to the EUDR requirements in future. Incorrect or inaccurate declarations can not only lead to delays in import and customs clearance, but in extreme cases also to fines, confiscations or damage to the company's image as a result of breaches of the EUDR. It should also not be underestimated that customs and compliance departments must work closely together in order to ensure seamless verification under the EUDR. The initial implementation in particular requires clear processes and decision-making guidelines for classification.

Natural rubber vs. synthetic rubber - the basics

Origin and production in comparison

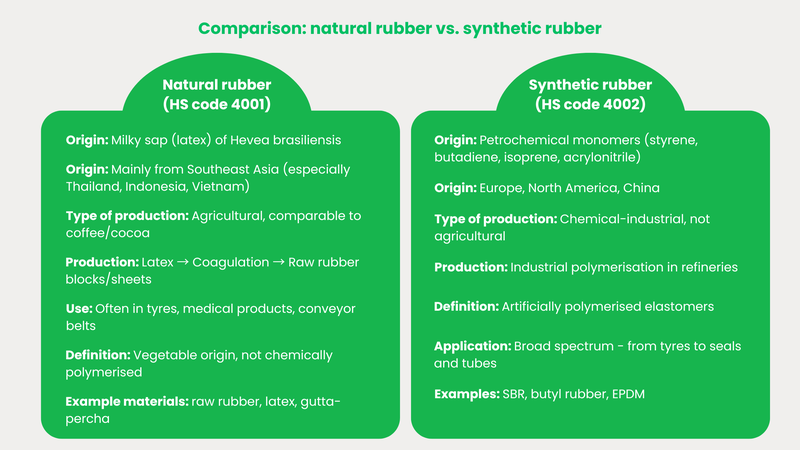

Over 90% of natural rubber is obtained from the latex of the Hevea brasiliensis tree. The main cultivation areas are in South East Asia, with countries such as Thailand, Indonesia and Vietnam dominating with around 70% of global production. After scoring the bark, the latex is collected, concentrated by coagulation and then processed into so-called raw rubber blocks or sheets. The extraction of this rubber is a classic agricultural primary production, roughly comparable to coffee or cocoa.

Synthetic rubber, on the other hand, is an industrially produced polymer product. Various petrochemical monomers such as styrene, butadiene, isoprene or acrylonitrile are used as starting materials, which are polymerized in refineries - primarily in Europe, North America and China. Well-known types include styrene-butadiene rubber (SBR), butyl rubber and ethylene-propylene rubber (EPDM). Unlike natural rubber, its production is not linked to agricultural land, but to industrial value creation and chemical processes.

Definitions in the context of customs law

Under customs law, a strict distinction must be made between natural and synthetic rubber. According to the EU customs tariff and the relevant EU regulations, the following applies: Natural rubber is rubber (raw rubber) produced by coagulation of hevea latex or related plant milk - regardless of whether it is in solid or liquid form. Synthetic rubber, on the other hand, includes all artificially polymerized elastomers whose main components are explicitly subsumed nationally and internationally under customs tariff number 4002.

Both the manufacturing process and the chemical composition are decisive for the classification and the EUDR classification. Mixed products, such as those used in modern car tires, are to be classified according to the main component - insofar as this determines the character of the goods. The corresponding legal basis is provided by the General Rules for the Interpretation of the Combined Nomenclature (GIR of the CN) of the European Union.

Relevant HS codes according to customs tariff

Two HS codes are central to classification in the customs tariff and the EUDR rubber classification:

- HS code 4001: this includes only natural rubber, balata, gutta-percha, guayule, chicle and similar natural rubbers, both raw and pre-processed. This also includes frozen, smoked or dried rubber.

- HS code 4002: this includes synthetic rubber, including "chemically modified" products. This applies to all petrochemically produced types of rubber.

Compliance with these HS codes is particularly critical in the context of the EUDR check and in international goods traffic: only goods under 4001 are relevant for the EUDR, while items declared under 4002 remain exempt. This has consequences for both the customs declaration and the subsequent compliance check. Companies should check existing goods databases, article master data and supplier declarations to ensure that they are correct and up to date for customs tariff classification.

Which types of rubber are affected by the EUDR?

Natural rubber within the scope of the EUDR

Natural rubber is explicitly listed in Annex I of the Regulation and is therefore subject to the requirements. As a result, comprehensive due diligence obligations must be fulfilled for all relevant products under HS code 4001 and for products made from them with rubber as the main component. This includes the provision of complete data on the supply chain, cultivation area and harvest year, satellite-based evidence of deforestation-free status and information on producers and intermediaries. In concrete terms, this means that anyone importing natural rubber - for example as a raw material or latex milk - must have all the necessary documentation on EUDR compliance ready before import and present it to the authorities, usually customs, on request. Downstream companies - such as tire manufacturers or textile companies - may also be affected if their goods or preliminary products contain a relevant amount of natural rubber.

Synthetic rubber is left out - why?

In contrast to natural plant-based rubber, synthetic rubber is of purely petrochemical origin. The EUDR classifies these products as "non-deforestation-relevant", as their production does not require any agricultural land or the clearing or cultivation of forest areas. For this reason, there are currently no specific EUDR requirements on traceability or proof of sustainability for the import and marketing of synthetic rubber - regardless of whether it is a raw material, semi-finished product or finished product. In practice, this regulatory loophole sometimes leads to shifts in competition, but it is in line with the objective of the EUDR: to reduce imported deforestation at EU level. Mixed products with a predominant proportion of synthetic rubber (and corresponding HS code) are currently not subject to reporting requirements.

Typical practical examples for classification

In practice, there are many challenges. For simple products such as household gloves, the classification can usually be made directly via the material code: If the gloves are made of 100% natural latex, they fall under the EUDR. However, if they are made of synthetic nitrile rubber, they are not affected. Another example is car tires, which usually contain material mixtures of natural and synthetic rubber. Here, it must be precisely determined which component determines the character of the end product. Companies are obliged to document which rubber (and in what proportions) has been processed by means of material analyses, supplier information and technical specifications. Conveyor belts in industry often consist of mixtures, whereby the base layer can also be decisive. Mixed products with a clear synthetic overweight are usually listed under 4002 despite natural components and are not EUDR-relevant. The situation becomes more complex for articles with a multi-layer structure or a low natural rubber content - here the material characterization and the usual classification logic according to customs regulations and EUDR often count.

How companies check the EUDR relevance of rubber in products

Classification based on the customs tariff and the Combined Nomenclature

The precise classification of goods according to the customs tariff and Combined Nomenclature (CN) is the first and most important step in ensuring EUDR compliance. Companies must check for each product whether its main component is to be classified as natural or synthetic rubber. The General Rules for Classification in the Customs Tariff (GIR 1 to GIR 6) and the Harmonized System (HS) Explanatory Notes are used for this purpose.

Investigations into the nature, origin and chemical composition of the products should be carried out on the basis of available product documentation and material data sheets. The result of the goods classification not only determines the applicable HS code, but also whether traceability and due diligence obligations exist in accordance with EUDR. Companies can use digital tools such as TARIC(the EU's electronic customs system) and the German portal "EZT-Online" to check the correct classification of the product and complete any missing information.

When products are considered EUDR-relevant

The decisive factor for EUDR relevance is whether a product or its components are considered natural rubber within the meaning of HS code 4001. It is not only the quantitative composition that matters, but also which component gives the product its technical and economic character. Products with a dominant natural latex content, such as medical hoses or tires with a high natural rubber content, must be declared. On the other hand, products with mainly synthetic components or chemically modified rubbers are not subject to the regulation.

Companies should also be aware that EUDR thresholds or de minimis limits do not automatically apply: Even small quantities of natural rubber in the end product can result in it falling under EUDR as long as the content determines the main character of the goods. In case of doubt, it is advisable to obtain binding customs information or consult with specialized customs advisors.

Practical steps for checking the classification

In practice, cooperation between the customs department, purchasing and compliance is essential, especially in small and medium-sized companies. Start with an inventory of all products and product groups that contain rubber or are suspected of having a natural origin. Analyze the composition of the product as precisely as possible using the material lists, information on suppliers and technical data sheets. In the case of mixed products, document how the characteristic component comes about.

You should then compare the data obtained with the relevant customs tariff - ideally with digital support via TARIC or industry-specific software tools. If there are any doubts, you should proactively obtain customs information or an expert opinion. During ongoing operations, it is advisable to record all compliance-relevant documents (e.g. supplier declarations, certificates of origin) centrally and to be able to provide them to customs in an uncomplicated manner for each import. It is also advisable to introduce standard processes for the regular review of goods tariffs - for example, by means of monthly audits or spot checks with critical product groups. This is the only way to remain EUDR-compliant at all times, even in the event of product changes, new developments or a changing supplier structure.

Conclusion and recommendations for action

The EUDR marks a turning point for companies along the rubber and caoutchouc supply chain: The inclusion of natural rubber in the list of raw materials brings with it new, comprehensive information and verification obligations when implementing the EUDR. The correct classification of natural and synthetic rubber is the key factor for the legally compliant movement of goods and is decisive for the fulfillment of compliance and customs obligations.

This results in the following practical guidelines: Start with a systematic analysis of your product portfolio, identify all goods containing rubber and match them with the relevant HS codes. Particularly in the case of mixed products, pay attention to which rubber is the main character of the goods. Use electronic tools for tariff classification and implement clear processes for the procurement, documentation and use of certificates. If in doubt, obtain information from customs authorities or specialized service providers at an early stage. Cooperation with suppliers and internal specialist departments is essential to ensure complete traceability and risk assessment.

The early involvement of purchasing, production and compliance can prevent later complaints, delivery problems and financial losses. At a time when transparency is becoming increasingly important and the number of regulations is growing, the correct classification of natural rubber is crucial. It is the basis for sustainable and compliant business on the EU markets.

FAQ

The most important step is to precisely analyze the material composition and check which component gives the product its essential character. In addition, use the electronic customs tariff (TARIC) and EZT-Online to ensure that the correct HS code is used. Also document all supplier information and production details.

If products - e.g. tires or finished goods - are declared under the wrong HS code, this can lead to rejection at the border, fines, subsequent customs clearance or damage to the company's image. A breach of EUDR obligations is particularly serious, as it can lead to severe fines and exclusion from the EU market.

In most cases, comprehensible material documentation via supplier information, technical data sheets or factory specifications is sufficient. For particularly complex or new products, however, a laboratory analysis may be necessary to verify the character-determining content of rubber.

The EU's electronic customs tariff (TARIC), the German tool EZT-Online and special compliance management systems for supply chain traceability, such as our EUDR module, offer practical solutions for carrying out the EUDR classification.

The EUDR currently has no fixed threshold values. The decisive factor is whether the product is to be classified as a natural rubber product (HS code 4001) according to the customs tariff and goods description. Small quantities are relevant if they determine the character of the goods.