Group structures and SMEs - What thresholds apply under the EU Deforestation Regulation?

EUDR - Reading time: 8 Min

With the EU Deforestation Regulation (EUDR, Regulation (EU) 2023/1115), the European Union has introduced an important rule to make the import and trade of products in the EU more environmentally friendly and sustainable. The EUDR imposes various obligations not only on large multinational corporations, but also on small and medium-sized enterprises (SMEs) and complex groups of companies. In practice, this leads to numerous uncertainties, particularly with regard to the delimitation of responsibilities and obligations within group structures and SMEs. The correct application of the EUDR thresholds and an understanding of the specific obligations, also with regard to EUDR turnover limits, are crucial for legally compliant implementation and efficient integration of the EUDR requirements.

The most important information

The EUDR makes a clear distinction between large companies and SMEs - this determines whether full or simplified due diligence obligations apply.

Less than 250 employees and no more than € 50 million turnover or € 43 million balance sheet total - based on EU Recommendation 2003/361/EC.

Because the relevant values (employees, turnover, balance sheet) of affiliated companies must be calculated on a consolidated basis, even across national borders.

No. If the parent company or other affiliated companies are large, the subsidiary may lose its SME status.

They must ensure that they can produce, pass on and archive a valid reference number of the due diligence declaration for each product.

It is proof that a product has undergone EUDR-compliant due diligence - and must be carried with every transaction.

Through a clear allocation of roles (market participant vs. trader), central threshold checks, compliance processes and digital systems for managing reference numbers.

Executive Summary

The EU Deforestation Regulation (EUDR) imposes different due diligence obligations on companies depending on their role in the supply chain and company size. While market participants must implement a complete due diligence system including risk analysis and due diligence declaration, simplified requirements apply to traders - especially SMEs. Whether a company is considered an SME is based on the EU definition in accordance with Recommendation 2003/361/EC. The decisive factors here are fewer than 250 employees and an annual turnover of no more than 50 million euros or a balance sheet total of no more than 43 million euros. In the case of affiliated companies - for example within group structures - these thresholds must be examined on a consolidated basis. This means that a subsidiary can no longer be considered an SME despite having its own small structure if the group as a whole exceeds the thresholds and the EUDR turnover limits. Although SME traders do not have to carry out their own risk analyses, they must document the market participant's due diligence declaration, provide evidence of this via a reference number and archive the information for at least five years. Clear clarification of roles within company groups and documented, system-supported handling of reference numbers are key prerequisites for legally compliant EUDR implementation. Companies should regularly review their classification and establish suitable measures for implementation by the time the EUDR comes into force on December 30, 2025, as there are no transitional periods.

Regulation on deforestation-free supply chains: Objectives, background and obligations

The EUDR (EU Deforestation Regulation) aims to curb deforestation and forest damage worldwide by ensuring that only deforestation-free products enter the EU. It applies to companies that import certain raw materials or products into the EU or sell them within the EU. The regulation distinguishes between different types of companies. There are some exemptions or simplified rules for small and medium-sized enterprises (SMEs). The exact requirements that apply often depend on the size and structure of the company in question.

In day-to-day business, groups of companies in particular, such as parent companies, subsidiaries, holding companies or joint ventures, are often faced with the question of how to correctly determine and apply the thresholds and obligations of the EUDR. In addition, there is often uncertainty as to what role a company plays in the supply chain - be it as a market participant or as a trader - and how this affects implementation (e.g. due diligence obligations, documentation, risk assessment). Particularly in the case of complex group structures or small companies with a strong division of labor, it is important to identify the obligations precisely.

When do which EUDR obligations apply?

By December 31, 2025, companies in the EU must be able to demonstrate transparently that their products do not contribute to deforestation or forest degradation. The regulation particularly affects players that import relevant raw materials such as wood, coffee, cocoa, soy, palm oil, rubber and cattle products or are the first distributors in the EU. Products made from these raw materials are also important and must be taken into account. The EUDR makes a clear distinction as to whether a company acts as a market participant or trader and whether it is an SME as defined by the EU.

Market participants vs. traders - key distinction of the EUDR

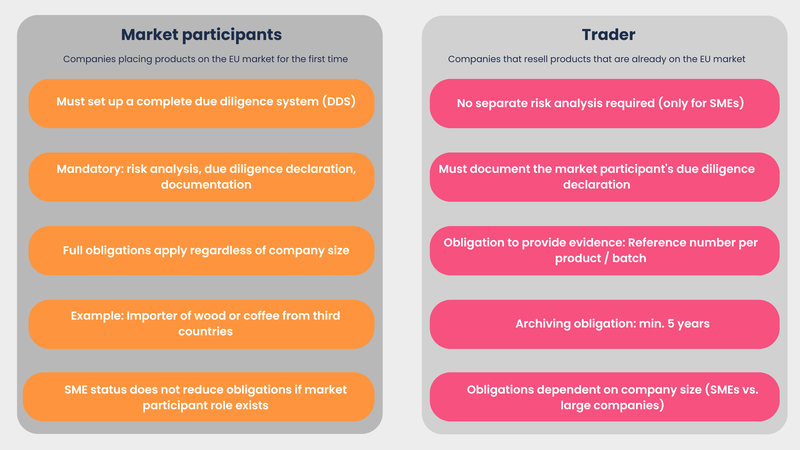

The EUDR initially differentiates according to the "functional role" of the participants concerned. In simple terms, a market participant is a company that places products on the EU market for the first time or exports them from the EU. Typical market participants are importers and manufacturers. Distributors, on the other hand, trade in products that are already available on the internal market - such as wholesalers or retailers, provided they do not act as market participants themselves.

Market participants are subject to the full due diligence obligation under the EUDR: they must submit their own due diligence statement , trace the origin of the products, obtain geographical data and prove that the products do not contribute to deforestation. Furthermore, a due diligence statement must be submitted for each shipment prior to import/export. Traders who are not SMEs are subject to similarly comprehensive obligations and must therefore comply with the DDS in key respects.

Small and medium-sized traders, on the other hand, benefit from simplifications in certain cases. Qualification as a market participant or trader and classification as an SME are therefore key factors in EUDR compliance.

Standard obligations and simplifications - the importance of company size

The standard obligations of the EUDR generally apply to all market participants - regardless of size. For traders, however, the decisive factor is whether or not the company is an SME as defined by the EU. The EUDR provides significant relief for traders who are classified as SMEs, as they do not have to submit a separate due diligence declaration for each delivery. Under certain conditions, they may refer to the due diligence declarations of their upstream suppliers.

Nevertheless, a number of documentation and cooperation obligations remain, e.g. for the retention of due diligence declarations and in the event of inquiries from authorities. From a practical perspective, it is therefore crucial whether a company - and thus also affiliated or subsidiary companies in the group - exceeds or falls below one of the EUDR thresholds or turnover limits.

The EU SME definition: thresholds at a glance

In the context of the EUDR, the term SME is generally based on the European Commission's Recommendation 2003/361/EC. The definition based on this sets precise financial and personnel thresholds.

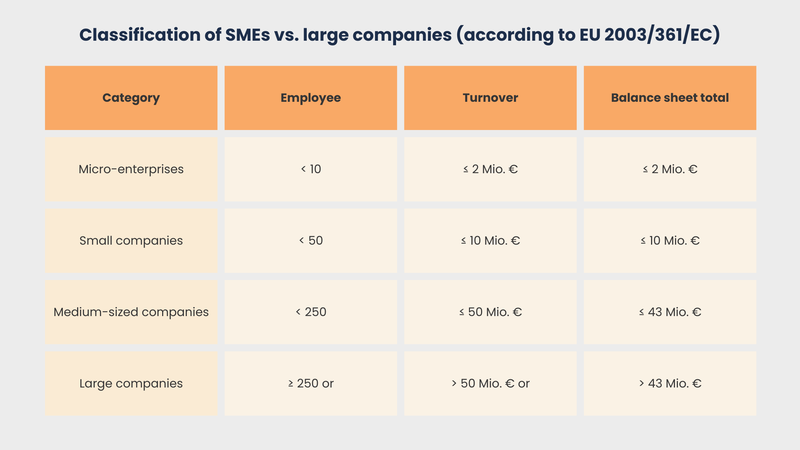

A company is considered an SME if it has fewer than 250 employees and either an annual turnover of no more than 50 million euros or an annual balance sheet total of no more than 43 million euros. The decisive factors here are all employees and the consolidated financial figures within a group of companies, provided the company is affiliated with others.

The SME classification according to this definition also makes a further distinction within SMEs between micro-enterprises (fewer than 10 employees and no more than EUR 2 million turnover or balance sheet total), small enterprises (fewer than 50 employees, no more than EUR 10 million turnover or balance sheet total) and medium-sized enterprises (fewer than 250 employees, no more than EUR 50 million turnover or EUR 43 million balance sheet total). The reference to Recommendation 2003/361/EC is expressly binding for the application of the EUDR and helps to ensure uniform thresholds throughout Europe.

The level of the respective thresholds determines whether a company can claim regulatory relief (e.g. as an SME trader) or has to fulfill the full EUDR due diligence obligations of a market participant. The correct classification of company size requires a detailed examination - particularly with regard to shareholdings and group structures.

Group structures and holding companies - how are they counted?

In practice, many companies are part of groups, operate as subsidiaries, holding companies or have indirect shareholdings through subsidiaries. When implementing the EUDR, it is important to check whether a company is assessed individually. In some cases, however, the entire group of companies must be considered together in order to determine whether the SME thresholds have been exceeded.

Basic principle: Individual consideration of the legal entities

In principle, individual legal entities are considered under European law. A company that has its own legal existence and entry in the commercial register is therefore treated as an independent entity. As a result, the EUDR obligations are triggered at the level of the respective legal entity. However, this does not mean that group membership and economic interdependence with other companies are disregarded. The EU provides explicit rules for dealing with affiliated companies and partner companies, particularly for the application of the SME definition.

Consolidated view of affiliated companies

The EU SME Recommendation(Annex, Article 3) explicitly states that in the case of affiliated companies - i.e. groups, joint ventures, holding structures or subsidiaries with binding control - the thresholds are to be calculated on a consolidated basis. In concrete terms, this means that all employee numbers, turnover and balance sheet totals of the affiliated companies are added together in order to check the EUDR thresholds. Affiliated companies within the meaning of the definition are those that are majority-owned, directly or indirectly under common control or - conversely - constitute a subsidiary in terms of decision-making power and economic interdependence.

The EUDR turnover limit and the EUDR balance sheet total therefore apply at the level of the entire group, particularly in the case of internationally operating groups of companies that have their own purchasing or sales subsidiaries in several EU countries, for example. It is therefore not only the isolated size of the company that matters, but the entire "group". The Commission and the EUDR guidelines emphasize that the due diligence obligations should not be circumvented through artificial splits ("carve-outs").

For example: If a German parent company has 100 employees and a turnover of 49 million euros, but has a subsidiary in France with 170 employees and a turnover of 6 million euros, the relevant turnover for the EUDR threshold is the total value of 55 million euros (49 + 6), even if both companies individually would be below the SME threshold.

Examples of classification

Scenario 1: Subsidiary with its own business operations

A German subsidiary of an international group imports its own coffee products and operates as an independent legal entity. The company has 40 employees, a turnover of 6 million euros and a balance sheet total of 4 million euros. Its parent company, based in France, has 180 employees and a turnover of 30 million euros. As both companies are deemed to be affiliated companies, the key figures of both companies are added together when calculating the thresholds. If the overall group exceeds 250 employees or 50 million euros in turnover, the German subsidiary is not considered an SME either.

Scenario 2: Subsidiary as a functional unit without its own market presence

A wholly owned subsidiary only provides internal services for the parent company and does not have its own market presence or customers, but effectively acts as a service company. However, it has its own entry in the commercial register and prepares its own accounts. Here too, the employee and financial values of the parent company are attributed. Operational independence is not decisive for the SME classification as long as a participation threshold is reached.

Scenario 3: Holding structure with several small units - addition effect?

A holding company holds 100% of the shares in each of five companies, each of which has 30 employees and a turnover of EUR 6 million. Each subsidiary must be checked to see whether it is considered a separate SME. The decisive factor here is that, according to EU regulations, the number of employees and turnover of all affiliated companies are also taken into account. This means that the threshold of 250 employees and 50 million euros in turnover is exceeded, meaning that none of the subsidiaries are considered to be independent SMEs, even if they were individually small.

These examples show how important careful group-wide analysis and documentation is in order to be able to assess one's own EUDR obligations in a legally compliant manner.

Requirements for SME retailers in the supply chain

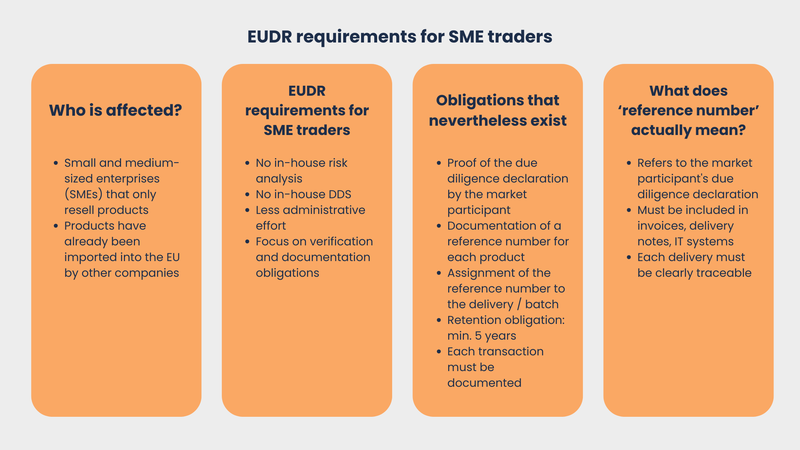

Many small companies are not market participants under the EUDR, but only act as traders. They sell products that other, usually larger, companies have already imported into the EU. According to Article 6 of the EUDR, special, simplified rules apply to such SME distributors.

Facilitations for SME traders in accordance with EUDR

The EUDR regulations stipulate that SME traders are not obliged to carry out their own due diligence statement (DDS) for affected products. An independent risk analysis, as required for market participants, is also not required for this group of companies. The EU Commission justifies this simplification by reducing the administrative burden for smaller companies. This significantly reduces the workload for SME traders: they can focus on core obligations without being subject to the comprehensive documentation and analysis obligations of market participants.

Obligations that nevertheless exist

Even though SME traders are exempt from many administrative obligations, they are not completely exempt from the EUDR. Key obligations include, in particular, the fact that every trader must provide evidence of and archive the market participant's due diligence declaration. For each transaction, it must be ensured that a unique reference number for the respective due diligence declaration is available and can be clearly assigned to this product or its batch. In addition, the EUDR requires SME traders to retain the evidence for at least five years for the competent authorities or audits. This documentation obligation extends to all transactions with affected products within the supply chain.

Reference number instead of full DDS - what does this mean in concrete terms?

The reference number is the central link in EUDR compliance for SME traders. It refers to the due diligence declaration issued by market participants and must be documented for every delivery. In practice, this means that when selling or reselling a product covered by the EUDR, every invoice, every delivery bill and every entry in IT systems must explicitly include such a reference number.

From a technical perspective, companies can adapt existing ERP, merchandise management or compliance systems so that the recording, archiving and reporting of the reference number is automated. Organizationally, clear processes must be established to ensure that the associated due diligence declaration is clearly linked to each relevant transaction and can be checked at any time. Safeguarding against sources of error, duplication or loss of reference numbers is crucial, as missing or incorrect information can lead to sanctions in the event of an audit.

Recommendations for action for corporate groups and SMEs

For an efficient implementation of the EUDR obligations, a proactive approach in four central steps is recommended.

Clarification of the distribution of roles within corporate groups

Within companies or groups of companies, a clear distinction must first be made between market participants and traders. Who is actually importing into the EU for the first time? Who is reselling? These questions are also important for the practical division of tasks. In the case of related business activities, it is advisable to install a responsible function (e.g. compliance officer), which takes over the allocation and monitoring of EUDR obligations and ensures group-wide consistency. It must be documented for each individual company in the group whether it acts as a market participant or trader within the meaning of the EUDR. It makes sense to clearly define the due diligence obligations and, if necessary, have them handled centrally by the parent or holding company, provided this is possible in accordance with the law.

Uniform valuation within the Group

The review of SME status and the relevant thresholds should be documented annually in a comprehensible manner as part of the financial statements or reporting on the corporate structure. Close coordination with the internal legal and compliance department is recommended in order to ensure a uniform interpretation of the relevant EUDR thresholds within the group. Every change in the corporate structure - for example, due to new investments, divestments or newly founded companies - must be transparently included in the assessment. The documentation of the threshold test is also essential because it can be used as proof of the claimed simplifications or obligations in the event of an audit.

For SME dealers: Efficient system for managing reference numbers

SME traders are recommended to use existing software solutions such as ERP or compliance systems to manage the EUDR reference numbers. Are you already familiar with our EUDR module? With this module, all necessary EUDR-relevant checks can be carried out automatically in just one platform. It makes sense to integrate the entry of the reference number as a mandatory field in the workflow for goods receipt, invoicing and warehouse management. At the same time, companies benefit from clear processes for passing on the number within the supply chain, archiving and audit-proof storage. Every employee in retail, purchasing or sales should be made aware of the importance of the reference number so that there are no gaps in verification. A precisely documented and regularly reviewed process for managing reference numbers reduces the risk of official complaints and ensures legal certainty for all transactions.

Conclusion

The EUDR places far-reaching organizational and compliance requirements on large group companies as well as small and medium-sized enterprises. It is crucial to correctly determine whether a company acts as a market participant or trader within a group - an error in this classification can have serious legal consequences. There are substantial simplifications for SMEs, such as exemption from the obligation to carry out their own risk analysis as a trader. Nevertheless, they are not completely exempt from EUDR responsibility. In particular, the documentation and administration of the due diligence declaration and reference number remain mandatory and must be designed carefully and in an audit-proof manner.

Against the background of complicated group structures, the consolidated values of the group always apply when calculating the EUDR thresholds. Practice shows that this is where sources of error lurk and close coordination with the legal and compliance department is essential. By consistently clarifying roles, continuously reviewing threshold values and introducing efficient systems for managing reference numbers, corporate groups and SMEs create the basis for legally compliant EUDR conformity.

FAQ

As soon as a company, together with its affiliated companies, exceeds the thresholds defined in Recommendation 2003/361/EC, it loses its status as an SME for the EUDR. This means that, as a trader, it must carry out the due diligence obligations and any risk analyses itself and can no longer benefit from the simplifications.

Yes, when assessing the SME thresholds, foreign companies are also to be considered together with the subsidiary based in the EU if they are affiliated companies in the sense of EU law. The consolidated values of the entire group are always used.

With a professional system for collecting, managing and archiving EUDR reference numbers, SME retailers can ensure that they can prove at any time which due diligence declaration their products are based on in the event of official inspections. This prevents sanctions and considerably simplifies the obligation to provide evidence.

The EUDR itself does not provide for any transitional periods: Due to the postponement of the EUDR by one year, the requirements will come into force from December 30, 2025. Companies should therefore review their structures at an early stage and make the necessary adjustments in order to be legally compliant from this date.

The competent authorities of the EU Member States are responsible for compliance, monitoring and enforcement of the EUDR. They may carry out audits, spot checks and inspections and request complete information from companies - in particular due diligence declarations, associated reference numbers and other evidence. Violations may result in fines or other sanctions.