Due diligence obligations along the supply chain - who has to do what and when?

EUDR - Reading time: 10 Min

The EU regulation on deforestation-free supply chains (EUDR) marks a paradigm shift in sustainability regulation: the focus is no longer just on raw material importers, but on the entire supply chain. The EUDR obligations are also increasingly affecting downstream market participants and retailers - with far-reaching consequences, especially for SMEs. But who is actually affected? What documentation and risk analysis obligations apply? And how can you determine your own role in terms of the EUDR with legal certainty? This article brings clarity to the complex requirements of the EUDR for traders and market participants. We show how responsibilities are distributed along the supply chain, what obligations exist and how companies can make their processes efficient and compliant - including examples, recommendations and specific implementation tips.

The most important facts at a glance

Market participants bring relevant products onto the EU market for the first time or export them. Traders trade in products that have already been imported within the EU. The classification determines the scope of the obligations.

They must carry out a risk analysis for each batch and submit a due diligence declaration with proof of origin, geodata and proof of legality and deforestation.

Retailers do not have to prepare their own risk analysis, but they are obliged to keep and pass on evidence from their suppliers and ensure traceability.

Only if it is complete, plausible and relates to the specific batch. In the event of ambiguities, high-risk regions or contradictory information, a separate check is required.

Whenever the batch is mixed, processed or modified - or if complete traceability is not guaranteed. In such cases, a new reporting obligation arises.

Executive Summary

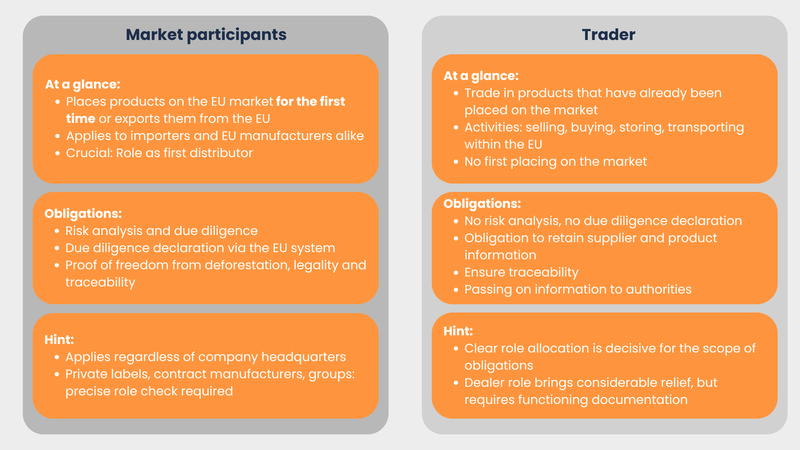

The EUDR obliges companies to ensure that certain raw materials and products made from them are deforestation-free, legally produced and traceable. The distinction between market participants and traders is crucial. Market participants - i.e. companies that place relevant goods on the EU market for the first time or export them - must carry out a risk analysis for each batch and submit a due diligence declaration. Traders, on the other hand, who trade in products that have already been imported, are not subject to a risk analysis obligation, but are obliged to keep and pass on evidence and to ensure traceability.

The one-off due diligence declaration of a market participant can, under certain conditions, relieve downstream actors of obligations, provided the batch remains unchanged. However, new obligations may arise in the event of mixing, processing or re-export. A supplier's declaration is only sufficient if it is complete, plausible and relates to the specific batch. Additional checks are required in the event of discrepancies, high-risk regions or unclear supply chains. Retailers are also obliged to cooperate, for example through spot checks or queries in the event of suspicious circumstances. Correct assignment of roles, structured verification of supply chain information and a functioning system for documentation, tracking and risk assessment are key to implementation.

Understanding EUDR roles: Market participant vs. trader

Who is a market participant within the meaning of the EUDR?

At the heart of the EUDR is the distinction between market participants and traders. Any natural or legal person who places relevant raw materials (e.g. soy, palm oil, wood, beef, cocoa, coffee, rubber) or products made from them on the EU internal market for the first time or exports them from the EU is considered a market participant. The role of the first distributor is therefore decisive - regardless of whether it is an importer from a third country or a manufacturer based in the EU.

Market participants have the most comprehensive obligations under the EUDR. These include in particular the following legal requirements:

- Carrying out due diligence, including in-depth risk analysis along the supply chain

- Submission of a due diligence declaration via the EU information system

- Proof that the products are deforestation-free, legally produced and traceable - right back to the parcel of origin

These obligations apply regardless of where the company is based, provided that the product is placed on the EU market. In addition, market participants must ensure that the due diligence obligations under Art. 4 para. 9 EUDR have been carried out. They are obliged to make a due diligence declaration and refer to the reference number in accordance with Art. 4 para. 2, 9 EUDR. There is also a responsibility to comply with the due diligence obligations. This means that the market participant is responsible for the prior due diligence declaration referred to (Art. 4 para. 10 EUDR). This is particularly relevant in terms of liability.

It is therefore essential for internationally operating companies to precisely classify their role as a market participant - particularly with regard to group structures, supplier contracts and trade channels. So-called "private label" constellations or contract manufacturers should also carefully examine whether they are actually acting as market participants.

Who is a trader within the meaning of the EUDR?

Distributors within the meaning of the EUDR are natural or legal persons who purchase, sell, hold, store or transfer relevant products within the EU after first placing them on the market - but do not place them on the market themselves. Distributors therefore move downstream in the supply chain and have no direct influence on initial market access.

Examples of traders within the meaning of the EUDR are

- Wholesalers who purchase and resell products from an EU producer

- Retailers who buy and sell affected goods

- Logistics companies that transport or store relevant raw materials or products

Compared to market participants, traders are much less involved in due diligence obligations. They do not have to carry out their own risk analysis and do not have to submit a due diligence declaration. However, traders must ensure that due diligence has been carried out in accordance with Art. 4 para. 9 EUDR and refer to the reference number in accordance with Art. 4 para. 2, 9 EUDR. The trader remains responsible for the prior due diligence declaration referred to (Art. 4 para. 10 EUDR), which is relevant due to liability.

There are also retention obligations for relevant information, for example on suppliers, product categories and traceability. It must be possible to disclose this information at the request of the competent authorities.

The distinction is therefore relevant in practice: While market participants must actively check and document, the duty of traders lies more in passing on information and maintaining transparency. For many companies, a careful examination of whether they are really market participants or merely acting as traders can make compliance considerably easier.

The public reporting obligation (Art. 12 para. 3 EUDR) applies to both upstream and downstream market participants (non-SMEs) and non-SME traders.

Differences in duties at a glance

The EUDR therefore makes a clear distinction between market participants and traders when it comes to due diligence obligations. Market participants bear the most comprehensive responsibility: they must submit a due diligence declaration to the competent authority for each individual product batch, in which they prove that the products are deforestation-free, legally produced and traceable back to the cultivation or origin area. This requires a detailed risk analysis at batch level, the results of which must be documented and disclosed. Traders, on the other hand, have less far-reaching obligations. They do not have to submit their own risk analyses or due diligence declarations, but primarily pass on information within the supply chain. In particular, this includes keeping due diligence declarations and evidence from suppliers, submitting them to the authorities and passing them on to buyers. In addition, retailers must document from whom they have purchased the goods and to whom they have passed them on in order to ensure traceability. Overall, the active duty to check lies with the market participants, while retailers must primarily fulfill a mediating duty to provide information. It is therefore essential for companies to know their role in the supply chain in order to fulfill their obligations correctly and in compliance with the law.

Practical examples of role allocation

In order to make the sometimes abstract concepts of the EU Deforestation Regulation more tangible, it is worth taking a look at typical constellations from everyday business life. After all, it is only through concrete examples that it becomes clear how the roles of market participants and traders differ in practice - and which due diligence obligations result from this.

A classic case: A German company imports soybeans directly from Brazil, processes them into animal feed and sells them on within the EU. In this case, the importing company is clearly to be classified as a market participant within the meaning of the EUDR. It is bringing the goods onto the European domestic market for the first time and is therefore obliged to carry out a risk analysis for each batch of soybeans and to submit a due diligence declaration to prove that the goods are deforestation-free, legal and traceable.

The next step in the supply chain is a feed wholesaler who purchases the feed produced by the importer and sells it on to farms. This wholesaler is no longer considered a market participant, but a trader, as the goods have already been placed on the market by the importer. He does not have to submit a new due diligence declaration himself, but is obliged to keep the relevant declarations and evidence from his supplier, to submit them to the authorities if necessary and to pass them on to his customers. They must also be able to document in a traceable manner who the goods came from and to whom they were delivered.

Another example shows the role of processors within the EU: a furniture manufacturer purchases tropical wood from a European timber trader who previously imported the material from a third country. Here too, the goods have already been placed on the market - by the original importer. The furniture manufacturer is therefore not acting as a market participant, but as a trader. Its obligation is limited to keeping the due diligence declaration and other evidence from its upstream supplier and making it available on request. A separate risk analysis or new due diligence declaration is not required in this case.

These examples illustrate how important it is to carefully classify your own role within the supply chain. Only those who know exactly whether they are acting as a market participant or trader in a specific case can correctly fulfill their obligations for the raw materials concerned under the EUDR and avoid liability risks. Especially for companies with complex or changing business models, an early, legally sound review of the EUDR role allocation is recommended.

Downstream market participants and EUDR compliance?

What are subsequent market participants?

In the context of the EUDR, the question often arises as to what is meant by "downstream operators". According to the definition, this refers to companies that acquire relevant raw materials or products that have already been placed on the market from another market participant and in turn either process, package or place them on the market again. In practice, these downstream players are often part of complex value chains, such as industrial processors, packers or re-exporters within the EU.

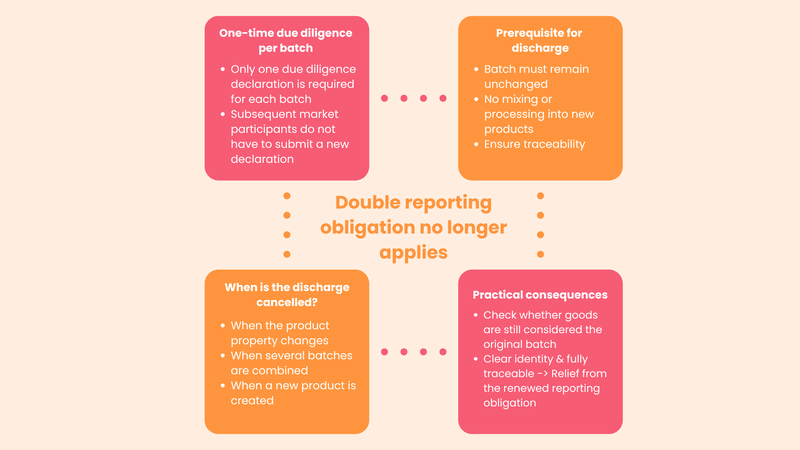

Principle: No double reporting obligation

A key point for relieving the burden on companies is the principle that a due diligence declaration does not have to be submitted more than once for the same batch of a product. This means that if a market participant has already provided a product with a full due diligence declaration in the past and imported it into the EU market, subsequent market participants do not have to submit a new declaration for this batch. This principle is often referred to as "single due diligence" and is intended to prevent the need for multiple complex risk analyses and declarations for the same goods. This significantly increases the efficiency and feasibility of the EUDR - especially for long supply chains or supply chains with a division of labor. This approach has also been confirmed by information and interpretations from the European Commission. Under certain conditions, companies that process, trade or resell products can rely on the due diligence declaration already made by an upstream market participant.

However, this principle does not apply without restriction. It is important that the batch in question remains a clear, unaltered unit. As soon as the goods are subsequently mixed, reworked or further processed to such an extent that a new product characteristic or a new product is created, a new due diligence obligation may arise. Even if individual batches are combined without their traceability being guaranteed, the exonerating effect of the original declaration no longer applies. In practice, this means that companies must carefully check whether the goods they process or pass on are still considered the same "batch" within the meaning of the EUDR - or whether further processing or mixing creates a new product unit. Only if the identity and traceability of the original goods are retained does the relief provided by the one-off notification obligation apply.

Special cases and exceptions

Even if the principle of a single due diligence declaration applies, there are certain cases in which a new or supplementary declaration may be required. This mainly concerns situations in which a subsequent market participant mixes, recombines or further processes an already notified product, resulting in a new relevant product. In such cases, the original due diligence declaration may no longer be sufficient, as the composition or traceability of the goods has changed. Re-exports to third countries are another special case: If a product leaves the EU internal market again, this may require a new due diligence declaration - depending on how the product was previously processed or repackaged.

Constellations with mixed goods, i.e. products that consist of different raw materials or components with different origins, are particularly complex. This applies, for example, to pre-packaged foodstuffs, processed wood products or chemical products. In such cases, the EUDR generally requires that each individual component of origin remains clearly traceable. For sectors such as the food and chemical industries in particular, this poses a considerable challenge - both technically and organizationally. Collection points, transshipment points or central warehouses should also carefully check whether they may be the first distributor. If different goods are newly combined or split up there, a separate reporting obligation may arise - especially if the batch loses its original form or the data collected is no longer clearly traceable.

These special cases show: Despite the principle of relief through the one-off due diligence obligation, companies are well advised to check their processes carefully. As soon as changes are made to the goods - whether through mixing, processing or relocation - a new obligation to submit a due diligence declaration may arise.

Risk analysis: When is it necessary?

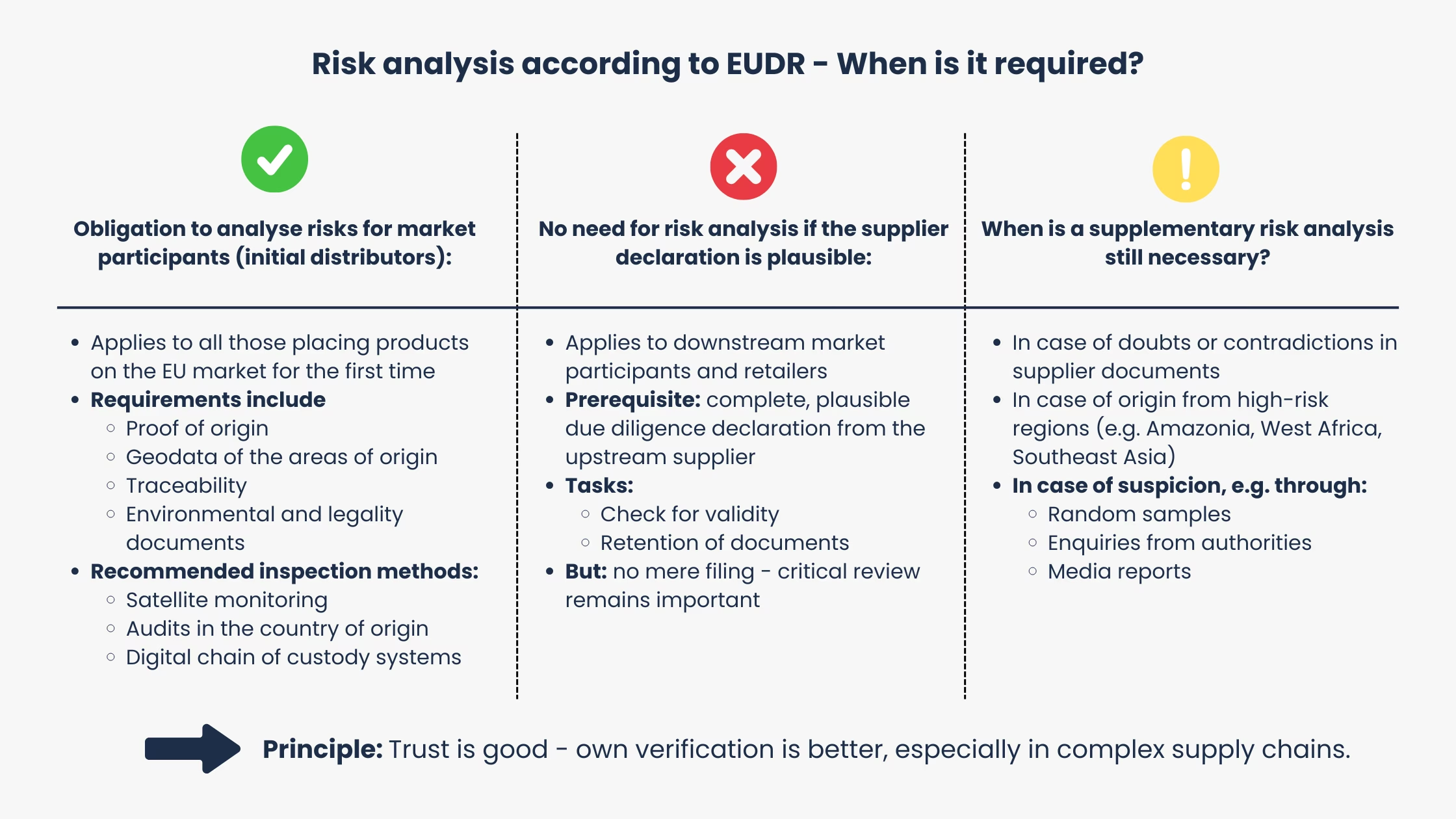

Risk analysis mandatory for first-time distributors

The EUDR obliges every market participant who places relevant products on the European market for the first time to carry out a comprehensive risk analysis. This analysis forms the core of the EUDR. The aim is to systematically and comprehensibly determine whether the exclusion of deforestation, forest degradation, forest degradation and legal violations is guaranteed along the entire supply chain. The risk analysis must take into account all available information: Proof of origin, geodata of the areas of origin, proof of traceability, environmental permits, legality documents and, where applicable, independent certificates are all part of this. In practice, this often means a considerable amount of documentation. Companies are required to use methods such as satellite monitoring, audits in the country of origin or digitalized chain-of-custody systems.

No need for risk analysis if supplier declaration is plausible

Not all actors along the supply chain have to carry out a full risk analysis on their own. If the immediate upstream supplier provides a legally binding due diligence declaration in accordance with EUDR and this is sufficiently plausible, the company can usually dispense with a new full risk analysis. In this case, it is often sufficient to validate the submitted declaration, check its validity and keep the documents in a traceable manner. The EUDR expressly stipulates that downstream traders and market participants are largely exempt from the detailed obligations of the risk analysis if they can rely on a trustworthy due diligence declaration from their upstream supplier. Nevertheless, in view of potential liability risks, it is advisable to critically check the quality and plausibility of the information provided instead of simply "filing it away". This is the only way to avoid the risk of fines and sanctions.

When a supplementary risk analysis may nevertheless be necessary

However, there are constellations in which a supplementary risk analysis may be required even if the upstream supplier has issued a due diligence declaration. This applies in particular if there are indications of inconsistencies, contradictions or non-transparent supply chains. It is also advisable to carry out further checks if products originate from countries or regions with an increased risk of deforestation or illegality - such as certain regions in South East Asia, West Africa or the Amazon.

Another practical case: If random checks, official enquiries or media research reveal a concrete suspicion of breaches of due diligence obligations, the company may be obliged to go beyond the usual supplier checks. The following principle therefore applies, particularly in the case of complex or convoluted supply structures: trust is good, but your own checks are better.

Concrete case studies

A supplier from Indonesia delivers palm oil to a European bottler and submits a due diligence declaration. However, the attached documents contain contradictory geocoordinates and independent reports warn of increasing illegal deforestation in the region. In such a case, it is not sufficient to rely solely on the supplier's declaration. Instead, an in-depth risk analysis is required, ideally supplemented by additional evidence or an external audit.

The situation is different when a German paper manufacturer purchases pulp from a certified supplier in Finland. The documents are complete and plausible and Finland is considered a country with a low deforestation risk. In such cases, no further assessment is usually necessary - provided there is no information to the contrary. These examples make it clear that companies must carefully consider in each individual case whether they can rely on the available documents or whether they need to carry out their own, more extensive checks.

Is the supplier due diligence declaration sufficient?

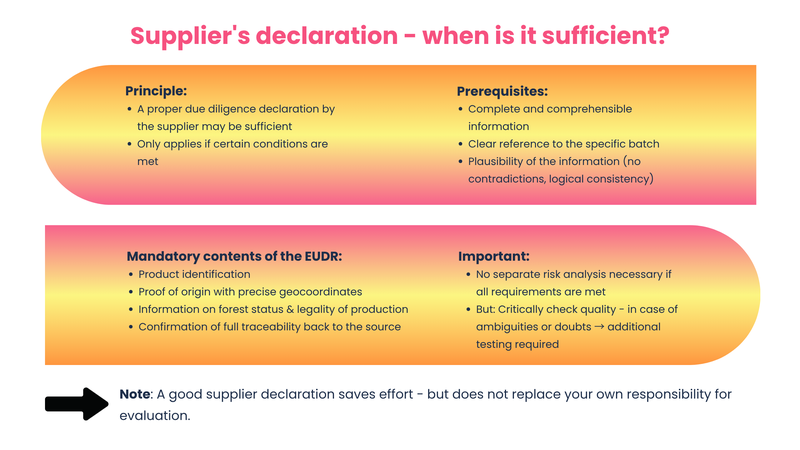

Principle: Yes, but only under certain conditions

A proper supplier due diligence declaration may be sufficient for companies to fulfill their own EUDR obligations. However, this only applies if certain conditions are met. The information provided must be complete, comprehensible and related to the specific batch. In addition, all essential information must be clear and plausible - particularly with regard to the origin of the goods, possible intermediate stages and the type of processing.

The EUDR stipulates exactly what minimum content a due diligence declaration must contain. This includes, among other things:

- clear identification of the product,

- exact proof of origin with precise geocoordinates,

- Information on the forest status and legality of production,

- and confirmation of full traceability back to the source.

If all these requirements are met and the information is supported by suitable documents, a downstream market participant can rely on the supplier's declaration. In this case, there is no obligation to conduct its own risk analysis, which significantly reduces the effort involved. However, it remains important to critically examine the quality of the supplier's declaration. If, for example, information is missing, unclear or there are doubts about the origin, the declaration alone is not sufficient. In such cases, the company must take action itself and obtain further evidence - up to and including its own risk analysis or additional inspection measures. In short, a good supplier declaration can save a lot of effort, but it does not replace the company's own responsibility to carefully evaluate the information.

What companies should look out for

Companies should not simply accept their suppliers' due diligence declarations without checking them. It is important to check the documents systematically: Is all the necessary information complete? Does the information fit together logically? Where possible, the information should be checked for plausibility using known data sources or satellite images. If anything is unclear, you should definitely ask the supplier questions.

Especially with a regulation such as the EUDR, where there is a risk of high fines and possible damage to your image, it is not enough to simply file documents. A formal review of the contents is absolutely necessary. It is particularly important that the declaration actually relates to a specific batch - and does not serve as a blanket declaration for the entire product range. Such blanket declarations generally do not meet the requirements of the EUDR. According to current figures from the European Forest Institute, over 30 percent of supplier declarations on the market are not fully compliant with the law. Anyone who accepts such declarations without checking them risks legal and financial consequences in the event of an inspection.

When a supplementary audit is necessary

An additional check should always be carried out if the documentation is unclear, contradictions or atypical information appear or if the supplier comes from a high-risk region. Particular caution is also required if there is a suspicion of falsified certificates, a lack of traceability or the presence of mixed products of unknown origin.

Companies should check whether the supplier has recognized certification systems, such as FSC or PEFC, and whether independent third parties have audited the supply chain. In addition, a specific risk assessment along the entire value chain is recommended, for example using IT-based tracking systems such as blockchain or specially developed inspection algorithms. In practice, pioneering companies often rely on a combination of document review, risk-based spot checks and systemic supplier assessment to fulfill their own EUDR obligations.

Is simple proof sufficient for retailers?

For distributors, the obligation to carry out comprehensive checks is somewhat weaker than for first-time distributors. In their case, it is usually sufficient to provide simple proof of the existence of a proper due diligence declaration from their suppliers and the traceability of the goods. Nevertheless, traders also have a duty to cooperate: if they receive information about breaches of the EUDR due diligence obligations or there are indications of unsafe documentation, they are required to take action.

From a liability law perspective, however, it is also advisable for retailers not to blindly trust the documents of their suppliers, but to carry out at least random checks and keep an eye on risk indicators.

Conclusion

The regulatory requirements of the EUDR bring new, comprehensive due diligence obligations for companies in the EU. Unlike previous regulations, it not only affects importers or manufacturers, but the entire supply chain - from the raw material to the finished product. Traders and downstream market participants must also fulfill certain documentation and verification obligations.

The principle of shared responsibility along the supply chain offers opportunities - for example through the relief provided by audited suppliers - but also harbors risks. Those who blindly rely on supplier declarations risk fines, reputational damage and liability. A good balance of trust, control and transparency is crucial.

Companies should therefore first clarify their status under the EUDR (market participant or dealer). Supplier assessment, risk analysis and documentation can then be built up in a targeted manner on this basis. Digital tools such as geo-tracking, blockchain or certificate databases help to manage evidence efficiently. In addition, training for specialist departments increases awareness of obligations and risks - and strengthens compliance in everyday life.

FAQ

A market participant is any natural or legal person who imports relevant raw materials or relevant products made from them onto the EU market for the first time or exports them from the EU. This applies both to importers from third countries and to EU companies selling goods within the EU for the first time. Distributors, on the other hand, are actors who resell, store or transport goods that have already been placed on the market within the EU without being the initial distributor themselves. They are subject to fewer obligations, in particular no risk analysis obligation.

Yes - in principle, a separate due diligence declaration is required for each batch before the goods are marketed or exported in the EU. This principle ensures traceability and legal compliance. Exception: If a product has already been correctly declared by a market participant and the batch remains unchanged, subsequent market participants do not have to submit a new declaration. However, if the goods are mixed, processed or recombined, this exemption does not apply.

A separate risk analysis is mandatory if the company acts as a market participant and places the goods on the market for the first time. In other cases - e.g. as a trader or downstream market participant - the due diligence declaration of the upstream supplier may be sufficient if it is complete, plausible and relates to the specific batch. Important: In the event of ambiguities, contradictory information or high-risk countries, it is advisable to carry out your own additional checks.

The declaration must contain certain minimum contents:

- A clear product description

- Acquisition of geocoordinates of the original area

- Information on forest status (deforestation-free)

- Proof of legal conformity of production

- Confirmation of traceability back to the source

- Information about suppliers and intermediaries

Only if these points are fulfilled and verifiable does the declaration meet the requirements of the EUDR.

Although retailers do not have to carry out their own risk analysis, they are obliged to cooperate. They must keep due diligence declarations and relevant evidence from their suppliers, present them if required and be able to pass them on to customers. They are also obliged to document the origin and whereabouts of the goods in a traceable manner. If there are doubts about the accuracy of the information or indications of violations, retailers must take action. Anyone who ignores these obligations can be held jointly liable in an emergency.

Companies should systematically check supplier declarations: Are all details complete and comprehensible? Does the geodata match the specified region of origin? Are there any known risks in the region of origin? In addition, publicly accessible databases, satellite images or certificates can be consulted. Good practice also includes enquiries to the supplier and spot checks.

A new declaration is required if one or more of the following information changes. This includes, for example, the origin of the goods, supplier or producer, transportation route or means, as well as significantly changed circumstances in the supply chain that influence the assessment of freedom from deforestation or legality.