EUDR compliance for composite products - when and to what depth must testing be carried out?

EUDR - Reading time: 7 Min

The requirements and adherence to EUDR compliance are currently occupying numerous companies from a wide range of industries. Those that work with complex product groups and mixtures of raw materials are particularly affected. Composite products in particular are at the top of the agenda, as it is often unclear at first glance which testing obligations actually apply and how deeply the supply chain must be traced and tested in accordance with the EU Deforestation Regulation. The combination of different materials and raw materials in a single end product in particular often causes uncertainty. The global, multi-layered supply chain also presents companies with new challenges. This article provides a classification for companies, product managers, purchasers and compliance officers.

The most important facts

Because they combine several raw materials with different EUDR references - some in main quantities, some in small proportions - and thus trigger complex supply chains and differentiated inspection obligations that cannot be answered in a generalized manner.

By checking whether the product falls under a CN heading listed in Annex I, whether it contains a relevant raw material such as wood, cocoa or palm oil, and whether this raw material is still present in a traceable form in the final product.

The CN determines whether a product is fundamentally affected. Only listed CN headings trigger EUDR obligations - supplemented by the TARIC database and specific additions such as "ex", which specifically affect individual subgroups.

Even small quantities of an EUDR raw material - e.g. cocoa powder in a chocolate bar or palm oil in a layer of packaging - may be subject to declaration if the raw material is still identifiable and the CN heading is affected.

If the raw material has been altered by processing to such an extent that traceability is no longer possible (e.g. by chemical transformation) or if the end product does not fall under a relevant CN heading.

A structured, interdisciplinary inspection process with clear responsibilities (e.g. purchasing, product management, customs, compliance), technical precision in product descriptions and regular reviews of product ranges and supply chains.

Executive Summary

The EU Deforestation Regulation (EUDR) poses considerable challenges for companies, particularly when it comes to composite products. Such products consist of several materials and often combine different EUDR-relevant raw materials such as wood, cocoa or palm oil, which results in complex supply chains and differentiated testing requirements. The decisive factor for compliance is not just the raw material content, but whether the end product falls under a CN heading listed in Annex I of the EUDR and whether the raw material it contains is still considered essential. The Combined Nomenclature (CN) serves as the central classification system here, while so-called "ex" headings enable a more precise classification.

To ensure legally compliant classification, companies must establish systematic review processes - starting with the identification of all relevant raw material components, through correct tariff classification to the final assessment of EUDR relevance. Close cooperation between purchasing, product management, customs and compliance is essential. Common mistakes - such as general assumptions, inaccurate material descriptions or overlooking hidden raw material components - can be avoided through structured processes, precise documentation and regular portfolio analyses. The article thus provides a practical guide to effectively implementing regulatory requirements and minimizing risks in relation to EUDR violations.

The challenge: Composite products in the context of the EUDR

More and more everyday and capital goods consist of numerous individual components sourced from very different raw materials. However, the EU Deforestation Regulation targets specific groups of raw materials, above all wood, cocoa, coffee, soy, palm oil, cattle and rubber, as well as individual products made from these. Composite products break through this categorization, as they combine several of these raw materials - sometimes as the main ingredient, sometimes in traceable small quantities or as a component of intermediate products. This inevitably leads to a number of special testing requirements for which a suitable solution must be found in order to efficiently meet regulatory requirements.

A great deal of uncertainty arises primarily due to material mixtures and the complex international supply chain. Many companies are faced with the task of carrying out a reliable and legally secure assessment for products with a proportion of EUDR-relevant raw materials (such as furniture with wooden frames, packaging coated with palm oil, chocolate bars with cocoa powder). Such products, whose raw materials have contributed to deforestation and deforestation of forests, may no longer be imported into the EU. In addition, due diligence declarations (DDS), risk analyses and, where applicable, proof of certification must be available for the above-mentioned processed raw materials in order to guarantee freedom from deforestation. At the same time, unclear responsibilities within the organization and a lack of transparency in partial supply chains pose additional risks for compliance and EUDR conformity.

Basics: Composite products and the EUDR

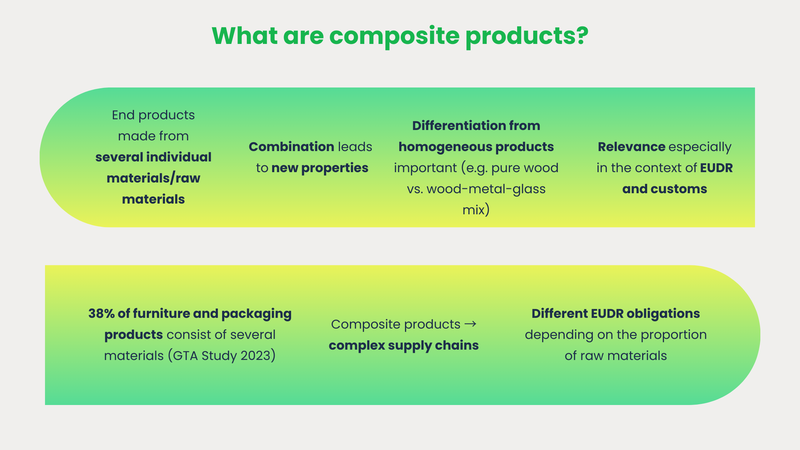

What are composite products?

The term "composite products" refers to end products that combine several individual materials. These combination articles consist of different raw materials that are processed in varying ratios to create a new product. Typically, this combination results in a product with different properties than the sum of its individual parts. A precise demarcation is essential in the EUDR and customs context: simple homogeneous products such as pure wooden boards or cocoa powder can be clearly demarcated. However, if a cabinet consists of wood, metal and glass, or if packaging contains a laminated layer of palm oil, it is referred to as a composite product.

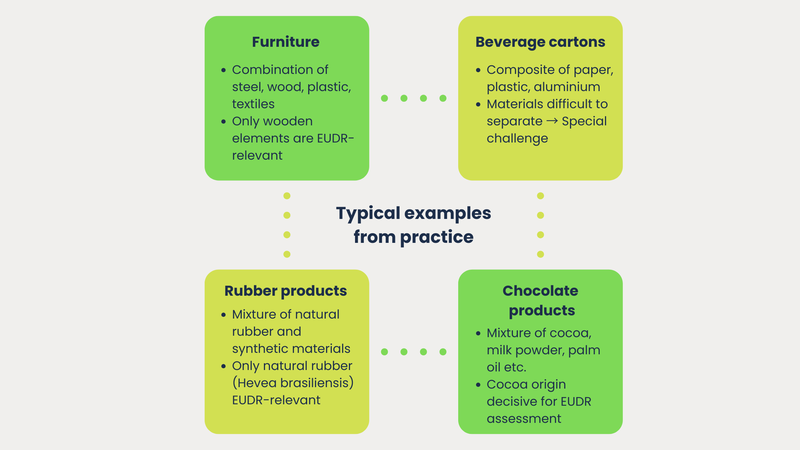

Typical examples from practice

The example of furniture illustrates the complexity particularly well. A piece of seating furniture often consists of a steel structure, wooden panels, plastic upholstery and a textile cover. In terms of the EUDR, all wooden elements are relevant here, but the entire piece of furniture does not necessarily have to be classified as EUDR-relevant. The issue is even clearer in practice with beverage cartons: here, paper (made from wood), plastic (usually from crude oil) and aluminum are processed into a composite that can hardly be separated from one another in terms of quantity. Rubber products with a proportion of natural rubber and synthetic components also give rise to differentiated testing, as only the natural rubber (if from Hevea brasiliensis) is covered by the EUDR.

In the food industry, the challenge is seen in chocolate products, for example, in which cocoa powder, cocoa butter, milk powder and various fractions of palm oil are processed together. Although the cocoa content of a chocolate bar usually only accounts for a fraction of the total mass, the raw material origin of the cocoa it contains plays a key role for the EUDR. These so-called composite products often have complex supply chains. Depending on which raw materials are included, different obligations may apply under the EUDR.

Commodity logic of the EUDR: When does relevance begin?

The EUDR always refers specifically to selected raw materials and products based on them. It is essential: Not every product with a "hint" of a problematic raw material that has contributed to forest degradation automatically entails the full due diligence obligation. The decisive factor is the legal classification based on the respective customs tariff number (CN), which is listed with specified product descriptions in Annex I of the EUDR.

The significance of this reference is revealed in the case of composite products, among other things, by whether the contained raw material is still "essential" and can be identified on the basis of the customs classification. Only when a product falls under an EUDR-listed CN heading is it checked whether the substantive link to the original raw material and the volume of the affected components contained trigger the declaration and verification process.

When is a product EUDR-relevant?

EUDR scope of application: Annex I and CN headings

Whether a product is subject to EUDR compliance is primarily determined by looking at Annex I of the regulation. This Annex lists all the raw materials and associated products concerned on the basis of the Combined Nomenclature (CN headings). Please note: Only products that fall under a listed CN heading are affected at all and are required to provide information. This limits the obligation to check and prevents all complex goods from having to be checked across the board.

Relevance criteria for composite products

For companies that trade in or import composite articles, there are three key criteria for assessing relevance in practice.

- Firstly, the decisive factor is whether an EUDR raw material is explicitly mentioned in the tariff description of the product - for example in the case of "wooden furniture", "cocoa products" or "rubber articles".

- Secondly, the so-called "ex" suffix in Annex I is particularly important. This abbreviation means that only a section of the product group is covered by the regulation, but not the complete CN heading.

- Thirdly, it must be checked whether a chemical transformation has taken place. However, it cannot automatically be assumed that a product loses EUDR relevance if it has been chemically transformed. The EUDR also applies to processed products, regardless of whether the original raw material is still directly recognizable - as long as the CN code is listed and the raw material has been used. The EUDR has no exceptions, as the decisive criteria remain the origin of the raw material and the CN code.

Examples of typical classification cases

A classic example of practical classification is the export or import of finished furniture with a visible or invisible wood component, such as a veneered shelf. As furniture with wood content is shown in detail in the CN, the reference to the EUDR can often be clearly established - provided that the piece of furniture falls under a commodity code listed in Annex I.

In the confectionery industry, even small amounts of cocoa by weight must be taken into account for chocolate products enriched with cocoa powder, especially because certain cocoa products are explicitly labeled as affected with the abbreviation "ex". The same applies to paper-based packaging coated with palm oil: Depending on the level of processing, the palm oil content may be subject to EUDR if the relevant CN code is affected. These classification issues are regularly the subject of disputes with the market surveillance authorities.

Understanding and correctly using the combined nomenclature (CN)

What is the combined nomenclature?

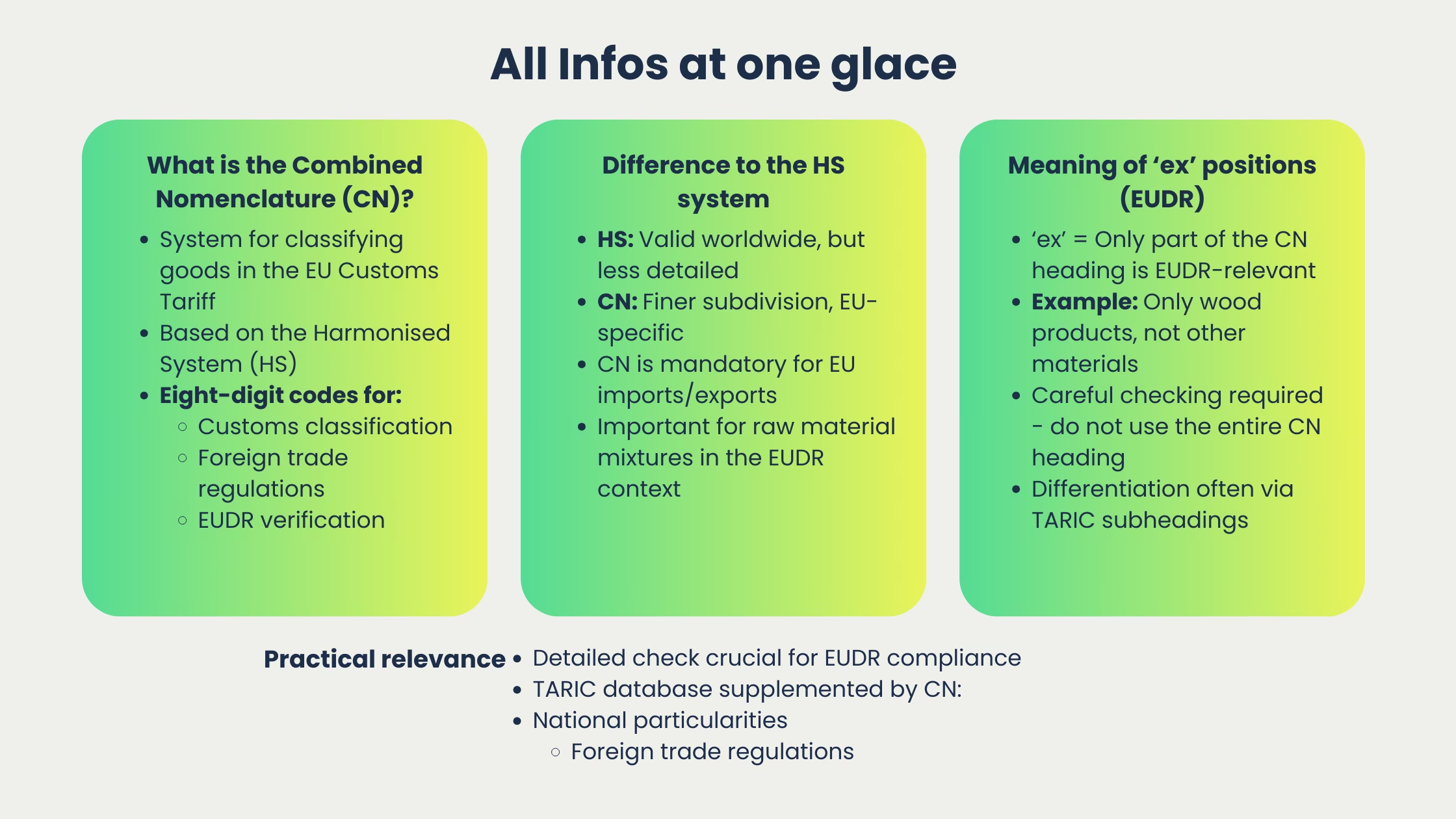

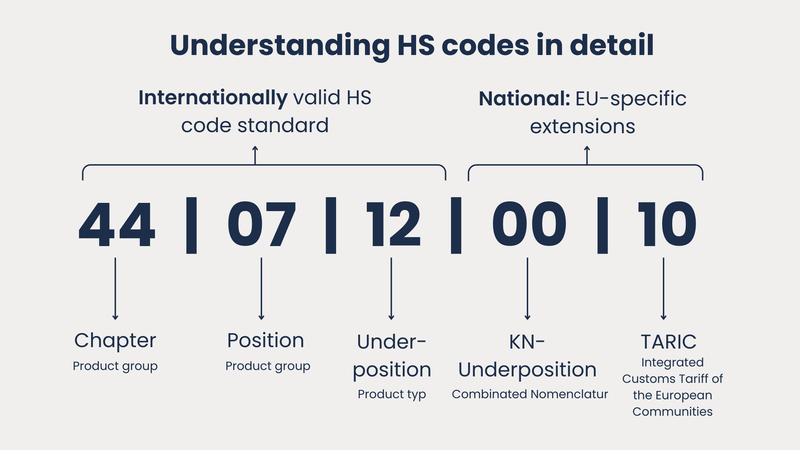

The Combined Nomenclature (CN) is the central system for classifying goods in the EU customs tariff. Based on the globally valid "Harmonized System" (HS), the CN offers a finer subdivision tailored to EU requirements and codes goods according to eight-digit codes. These are used both for customs classification and as a reference for numerous foreign trade regulations and are the core of the EUDR relevance check.

Difference to the HS code system

Although the HS classification forms the first basis for tariff classification, it is international and therefore often offers a less granular distinction than the EU CN. The latter goes deeper with additional numerical levels and must be used for imports and exports to or from the European Union. This additional level of detail is particularly important in the context of the EUDR: many products consisting of mixtures of raw materials can only be clearly assigned to the regulation on the basis of their CN number.

Meaning of "ex" positions in the EUDR

The term "ex" in Annex I of the EUDR indicates that only part of a CN heading is affected - for example, only products made of wood, but not those made of other materials. This can mean that even within an eight-digit CN heading, further differentiations must be made, for example via the TARIC subheading. At this point, companies must not classify the entire CN heading as EUDR-relevant, but must check exactly which subcategories are affected and how these are represented in their own product range.

In practice, it is therefore essential to look at the details. The EU's TARIC database expands the Combined Nomenclature to include national characteristics and specific foreign trade regulations - these can also be relevant for EUDR compliance.

Use in practice

The TARIC database is used to search for the relevant CN heading for a composite product. A very precise classification can be made here via product search, description, material and intended use. It is crucial that the product description is stored clearly and technically correctly in the company's own systems - this forms the basis for legally compliant tariff classification and subsequent documentation.

As part of EUDR compliance, it must also be ensured that all relevant product groups are continuously reviewed, especially if supplier structures, material compositions or product portfolios change. The technical documentation should therefore not only accurately reflect the final product, but also the raw material fractions it contains.

Practical test steps and implementation for companies

Systematic review of the EUDR impact

The necessary check as to whether a composite product is subject to the EUDR is carried out in several steps. The first step is to identify the product and all relevant raw material components along the supply chain. The second step is the tariff classification based on the CN and TARIC data. This is followed by a comparison with the listed items in Annex I of the EUDR. However, this serves as preparation, because only when all these test steps result in a match does the obligation to exercise further due diligence arise, in particular documentation, reporting and traceability obligations.

Practical tools and checklists can efficiently support this process. Companies that regularly work with material mixtures should create a database for the standardized classification of their product ranges and integrate automated reconciliation processes with CN and TARIC codes.

Organize collaboration within the company

Especially in the case of composite products, an isolated approach by individual departments is rarely effective. Instead, interdisciplinary cooperation should be established. Purchasing provides information on the primary product and suppliers, while product management knows the composition and can document changes. The customs department is an expert in correct tariff classification and can identify risks within the framework of the EUDR. Finally, the legal or compliance department checks compliance with due diligence obligations and provides information on appropriate documentation and communication with authorities. It is best to set up an internal review process in which responsibilities and review deadlines are clearly defined - for example, through an internal compliance board or a regular coordination meeting for new products or changes to the product range.

Avoid typical mistakes

A common mistake in practice is the basic assumption that every raw material component in a product makes the entire end product EUDR-relevant. In reality, however, the CN heading and Annex I comparison must always be considered together before a notification obligation is assumed. Blanket assessments, for example on the basis of parts lists or rough material descriptions, should therefore be avoided. The relevance of "hidden" raw material components is also often underestimated: In many cases, EUDR raw materials are only indirectly present, for example as an adhesive component, coating or in auxiliary materials. Special care is required here without triggering a complete reporting obligation as a knee-jerk reaction.

Conclusion

Checking whether complex and composite products are affected by EUDR requires a coordinated, systematic approach and the intelligent use of the combined nomenclature. The regulation provides a clear structure for determining which products are actually affected - the CN and TARIC provide the necessary detail to make the right decisions, even for mixed products.

Companies should carry out a broad portfolio analysis as early as possible in order to identify critical product groups and relevant raw material flows. Prioritizing EUDR and CN-relevant products creates efficient use of resources and reduces the risk of gaps in due diligence. With every change in product range or supplier, a regular review and, if necessary, an adjustment of the internal guidelines is recommended. Complete, comprehensible documentation of all inspection steps and assessment decisions is not only a legal requirement, but also a valid protective instrument in the event of inspections by the authorities and any queries from market surveillance authorities.

FAQ

The EUDR obligation only applies if the product falls under one of the CN headings listed in Annex I, which relates to one of the seven relevant raw materials. For composite products, it must be checked whether the raw material is explicitly mentioned in the tariff product description and whether the "ex" heading includes the specific article.

The HS code provides the basic international classification of goods, while the CN codes are the EU-specific classification system based on it with a greater level of detail. Only the CN codes and their subheadings are binding for the legal requirements of the EUDR.

Companies must check at least the position of the listed CN number and the specific product specification. In case of uncertainty, it is advisable to consult with the customs authority or obtain binding tariff information.

Particularly in complex supply chains with multiple production steps, manufacturing stages and material mixtures, it is crucial to obtain comprehensive information from the entire chain. Anyone acting as an importer remains responsible for the complete documentation of all relevant raw material components.