Self-consumption, self-import, interim solution - when does the EUDR apply and when does it not?

EUDR - Reading time: 10 Min

Since the European Deforestation Regulation (EUDR) came into force, many companies have faced new challenges - not only large trading groups, but also smaller companies that import or use raw materials such as coffee, cocoa, soya, wood, cattle, palm oil or rubber. The regulation goes further than it seems at first glance: it applies not only to trade, but also when deforestation-free products are imported from abroad solely for the company's own use, for example for the canteen, office, production or training courses. Companies that have previously operated purely locally or in-house are confronted with new questions. Does the EUDR also apply if there is no direct resale? And how should complex supply chains, intermediate products or shipping via third countries be handled? In this article, we shed light on when the EUDR applies - also with regard to self-consumption, self-import and intermediate solutions - and where the regulation leaves room for maneuver or requires interpretation.

The most important points at a glance

Yes, even if raw materials or products are imported from a non-EU country exclusively for internal use (e.g. in the canteen, production or administration), the EUDR obligations apply.

A product is considered to be placed on the market as soon as it is physically and legally made available on the EU internal market for the first time, regardless of whether it is sold or used internally.

Yes, as soon as an EUDR-relevant product is imported from a third country, a Due Diligence Statement (DDS) must be prepared and submitted, even without resale.

Yes, if raw materials or products are purchased within the EU, the EUDR does not apply if they have already been placed on the market and a valid DDS is available.

As long as a product is only transported through the EU and is not cleared through customs or stored, the EUDR does not apply. The obligations only apply when the product is made available on the internal market.

Executive Summary

The European Deforestation Regulation (EUDR) to curb global deforestation and forest degradation affects significantly more companies and use cases than is apparent at first glance. It applies not only to traditional trade transactions, but also to in-house imports, internal company consumption and intra-group transfers - regardless of whether a resale takes place or not. The only decisive factor is whether a product or raw material is made available on the EU internal market for the first time. The so-called "placing on the market" can therefore also occur if materials are imported from a non-EU country solely for internal use, for example in the canteen, office, production or for training purposes. In such cases, the same due diligence obligations apply as for commercial trade: companies must submit a due diligence statement and prove that the imported raw materials have been produced in a deforestation-free and legally compliant manner. However, products that have already been placed on the market within the EU are not covered by the EUDR. Pure transit through the EU without intermediate storage or customs clearance does not trigger any obligations either. Intermediate solutions, such as internal processing prior to export or mixed supply chains with import and export components, are critical - here it must be checked exactly when and where the EUDR applies. To avoid legal risks, a systematic and risk-based approach is recommended: this includes the clear assignment of responsibilities, well thought-out documentation, internal training and close cooperation with the compliance and legal departments. Only those who integrate the EUDR at an early stage can minimize liability risks, secure their own market position and contribute to more sustainable supply chains.

Principle: When does the EUDR Regulation apply?

The EUDR does not only apply to traditional retailers and producers

Numerous companies are currently finding that they are considered market participants within the meaning of the EUDR, even though they are neither traditional traders nor primary producers. Particularly in the case of intra-group uses, service providers with their own imports and independent operating sites, there is a lack of clarity: When does something count as "placing on the market"? Does the due diligence declaration (DDS) also have to be followed for own use of raw materials or own materials? The relevance of these questions increases due to the threat of sanctions and the expectations of business partners. Particularly in sectors such as production, food processing, office supplies or packaging, uncertainties regularly arise: When does the purchase of raw materials, for example for a company's own purposes, constitute a transaction subject to EUDR and when is own use clearly exempt from the regulation? Similar questions arise when exporting outside the EU or importing for special projects. Here, details such as the actual use, the intended purpose and the internal documentation determine the legal situation.

What does "placing on the market" mean according to the EUDR?

The EU Deforestation Regulation defines "placing on the market" as the first making available of a product concerned on the EU internal market - regardless of whether this is for commercial purposes or exclusively for own use. This means that even if a company only imports raw materials for its own use, for example for the canteen or production, this can already be considered "placing on the market" under the EUDR. If a product is imported from a non-EU country for own use, the EUDR regulations apply as normal. However, if a product for own use is purchased from an EU country, the requirements do not apply.

The legal basis is Article 2(16) and (18) of the EUDR, which deliberately define the term broadly. Accordingly, "placing on the market" also includes cases in which products are imported into the EU internal market for own use, internal processing or packaging. The regulation makes no distinction between commercial goods and internal use. The only decisive factor is that the product gains access to the EU market for the first time. Companies that have so far concentrated exclusively on internal company use often underestimate the scope of the regulation and therefore also their obligations to carry out due diligence.

Trade associations such as the Association of German Chambers of Industry and Commerce (DIHK) and consulting firms such as PwC expressly point this out in their interpretations: In-house consumption and intra-group transfers can also be considered "placing on the market" if they lead to the first making available on the EU market. The consequence: due diligence obligations apply regardless of the intended use or planned further processing.

Internal use may also be subject to EUDR

The EUDR makes no distinction between commercial trade and intra-company use. The only decisive factor is that a product or raw material enters the EU internal market for the first time. This means that even if a company imports an EUDR-relevant raw material, such as wood, leather, cocoa or soy, from a non-EU country exclusively for its own operations, this may already fall under the regulation. Typical cases that are relevant, for example

- Imports for technical trials or model production

- Use of materials for internal training or testing processes

- Use of products as office or laboratory equipment

- Procurement for own use, e.g. in canteens or for internal company events

All of these scenarios can be considered "placing on the market" within the meaning of the EUDR, even if the products are never placed on the free market. This shows that The regulation does not privilege internal use, but consistently focuses on the first market access within the EU. This harbors considerable risks: Companies that fail to provide clarity here not only expose themselves to possible fines, but also risk reputational damage and exclusion from supply chains if they do not comply with the EUDR requirements. The key recommendation is therefore: Every first-time provision of an EUDR-relevant product on the EU market, regardless of the intended use, must be checked to see whether the due diligence obligations of the EUDR apply. This is the only way to minimize legal risks and secure the trust of partners and authorities.

Own consumption of paper, coffee or cocoa

Companies often import everyday materials such as paper, coffee or cocoa exclusively for their own use. Many companies assume that the EUDR does not apply in these cases. However, a closer look at the regulation and its interpretation shows that the EUDR obligations are regularly triggered by imports or intra-Community acquisitions, even for internal purposes.

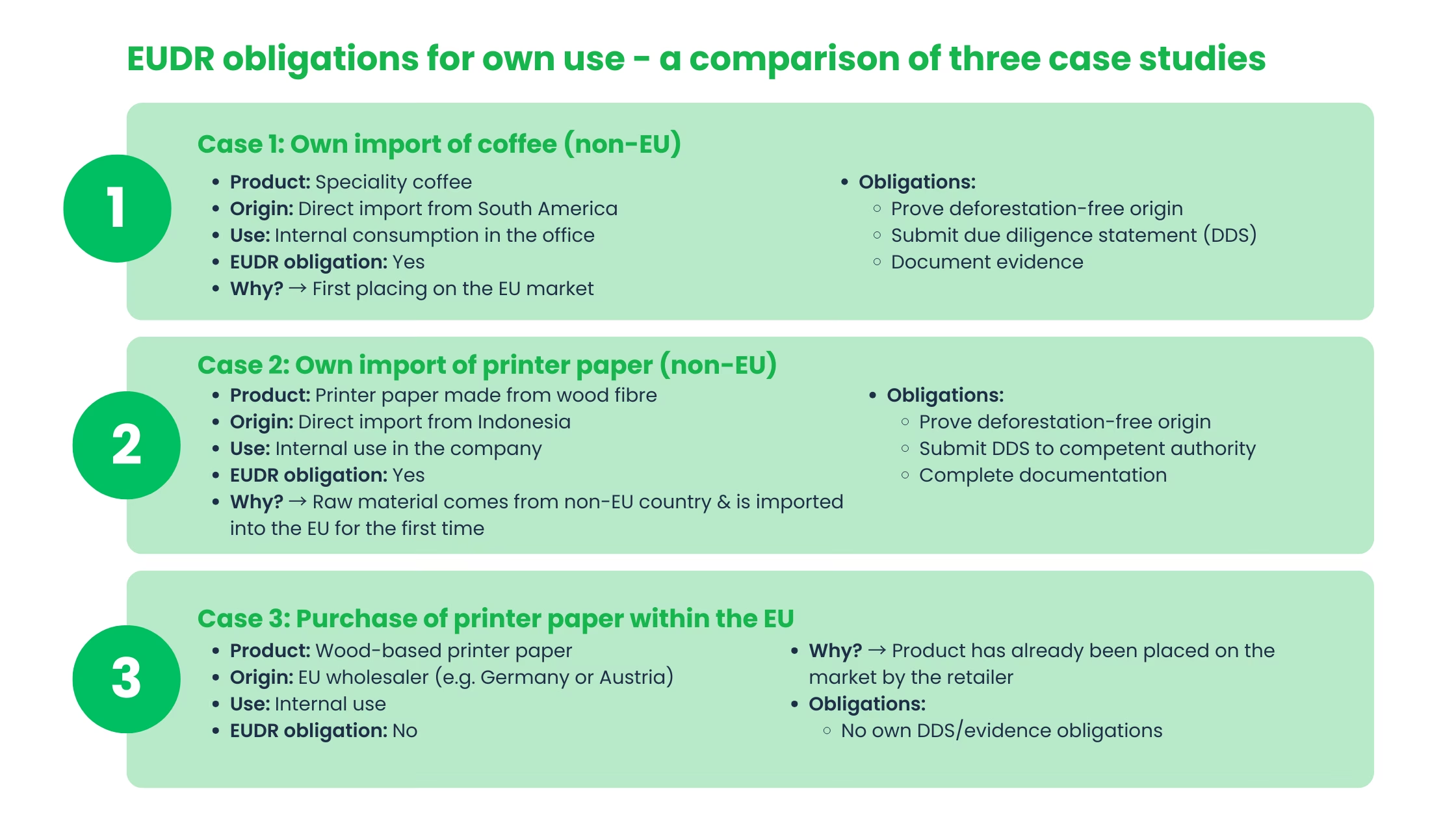

Case study 1: What applies to own consumption of imported coffee?

A medium-sized software company regularly purchases specialty coffee directly from a coffee farm in South America. The coffee is imported exclusively for the company's own use, as it is distributed to employees in the office and not sold on. Despite the purely internal purpose of use, the EUDR applies here. With the import from a third country, the coffee is made available on the EU internal market for the first time and is therefore considered to be "placed on the market" within the meaning of the regulation. The fact that the coffee is not sold, but only consumed, is irrelevant for the application of the EUDR.

The company must therefore:

- prove that the coffee was produced without deforestation and in compliance with the law

- submit a due diligence statement

- document the necessary records and checks

Other own imports from non-EU countries, e.g. cocoa, palm oil products or packaging materials made of wood, are also subject to the same obligations, regardless of their intended use in the company.

Case study 2: What applies to own consumption of imported printing material?

An industrial company imports printer paper directly from a manufacturer in Indonesia. The paper is used exclusively within the company, for example for internal communication, documentation and accounting. The paper is therefore not sold. Despite the purely internal use, the EUDR also applies in this case. The printer paper consists of wood-based fibers, one of the seven raw materials covered by the regulation. When the product is imported from a third country, it is placed on the EU internal market for the first time and is therefore considered to be "placed on the market" within the meaning of the EUDR.

This means for the company:

- It must prove that the paper comes from deforestation-free and legally compliant sources

- it must submit a complete Due Diligence Statement (DDS) to the competent authority

- it must carefully document all relevant evidence

The fact that the paper is only used within the company does not change the due diligence obligation. The only decisive factor is the initial market access within the EU - not how or by whom the product is subsequently used.

Case study 3: What applies when purchasing printer paper within the EU?

The situation is different for a company that purchases printer paper from a European retailer. Even if the paper is wood-based, it is purchased within the EU internal market, for example via a wholesaler in Germany or Austria. In this case, the EUDR no longer applies, as the paper has already been placed on the market by the retailer. The company is therefore not a "market participant" within the meaning of the EUDR, but merely a downstream user. A separate due diligence check is not required.

Important: The distinction is therefore not in the purpose of use (e.g. own use), but in the place and time of first placing on the EU market.

Self-consumption does not protect against obligations - market access counts

The EUDR assesses the first placing on the EU market. Whether a product is sold or used internally is legally irrelevant. The decisive factor is who imports it into the EU first.

Therefore:

- Imports from third countries - including for own consumption - are subject to EUDR.

- Purchases within the EU are no longer EUDR-relevant if the retailer has already created a DDS.

Even if the import is declared as "own use", the same reporting obligations and documentation requirements apply as for traditional trading transactions. Experts therefore advise that all processes relating to imports, own use and documentation should be closely coordinated with the legal department and compliance. The same also applies to technical materials made of wood, cardboard packaging or other EUDR raw materials that are used for internal operations, production or facility management.

Export and sales within and outside the EU

The situation is often even more complex when raw materials or products made from them are both sold within the EU and exported to third countries. The question of whether the EUDR obligations also apply to exports to non-EU countries and the clear delineation of what counts as "placing on the market" within the EU is therefore highly relevant for internationally active companies.

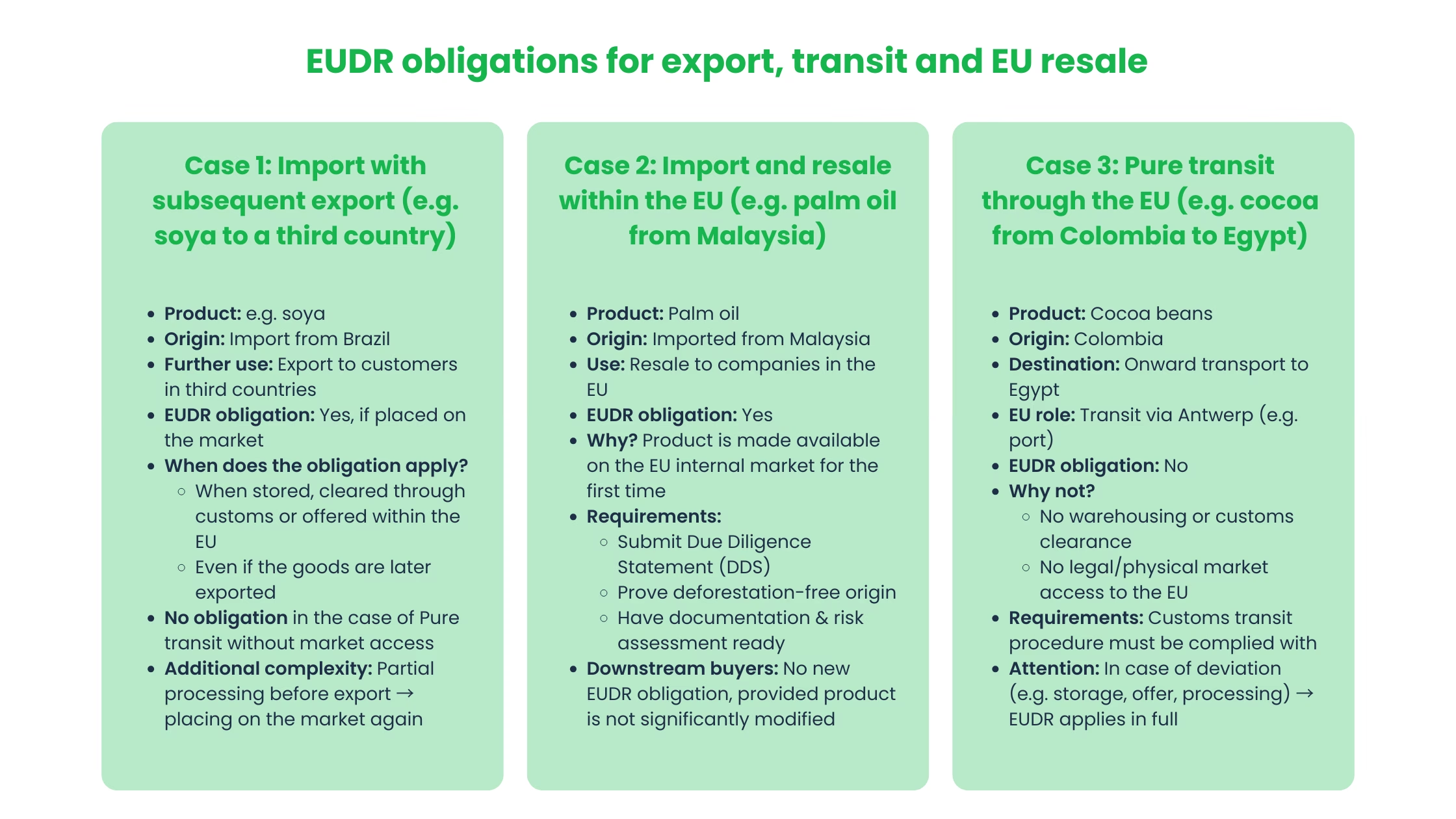

Case study 1: Does the EUDR also apply to exports to non-EU countries?

The EUDR is geared towards the EU internal market, but export scenarios can also trigger EUDR obligations under certain conditions. An internationally active trading company imports an EUDR-relevant product, for example soy from Brazil, to Germany. The product is not used or sold domestically, but is to be exported directly to a customer in a third country. The central question is: Does a due diligence check in accordance with EUDR also have to be carried out in this case, even though no domestic distribution is planned? The decisive factor here is the "placing on the market", not the export. According to the EUDR, the regulation only applies when a product is made available on the EU market for the first time. This means that

- If the goods are only transported through the EU (e.g. in transit), there are no EUDR obligations.

- However, if the product is stored in the EU, cleared through customs or offered on the internal market - even if it is not actually sold - it is deemed to have been "placed on the market".

At this point, the due diligence obligations apply in full. The company must then carry out a full due diligence check and submit a DDS (Due Diligence Statement), even if the product is subsequently exported to a third country.

It becomes even more complex if the imported goods are first partially processed or repackaged before they are partially or completely exported outside the EU. We would like to illustrate this with an example: a raw material is transformed into a semi-finished product in the EU and is then partly exported, while another part is further processed or sold internally. In such cases, each step in which a product is made available on the EU market or passed on is considered a new "placing on the market".

In the case of pure transit or direct export without placing on the market, no EUDR obligations must be complied with. However, if the product is stored, processed or offered in the EU, the EUDR obligations apply in full. Companies with international supply chains should therefore carefully examine their import, storage and export processes and work closely with customs, logistics and compliance, particularly in the case of intermediate solutions.

Case study 2: Does the EUDR apply if goods are imported from a non-EU country and then resold in the EU?

A wholesaler based in France imports palm oil directly from a producer in Malaysia. The goods are cleared through customs in France, stored in a warehouse and then sold on to various processing companies within the EU, for example in Belgium and Italy. In this case, the EUDR obligations clearly apply. This is because when the palm oil is imported from a third country and then made available on the EU internal market, the goods are deemed to have been "placed on the market" within the meaning of the regulation.

This means:

- The trader in France is a "market participant" within the meaning of the EUDR

- He is obliged to carry out a complete due diligence review

- A Due Diligence Statement (DDS) must be uploaded to the EU information system prior to import

- They must provide clear evidence that the palm oil was produced without deforestation and in compliance with the law

- The documentation and risk assessment must be able to be presented at the request of the authorities

If the product is resold in the EU, for example to companies that only process it or do not resell it, there is no new EUDR obligation. The prerequisite is that the product does not change significantly and a valid Due Diligence Statement (DDS) is available. The obligation lies with the first distributor.

The EUDR applies without restriction to imports from third countries with subsequent marketing within the EU. This applies regardless of whether the sale is made to end consumers, processors or other traders. Companies that are the first to import raw materials or affected products into the EU market are responsible for complying with all due diligence obligations.

Case study 3: Does the EUDR apply to pure transit through the EU?

A trading company from Switzerland organizes the transport of cocoa beans from the Ivory Coast to a customer in Egypt. The goods are imported into the EU via a port in Antwerp (Belgium), but are not stored or cleared through customs. Instead, they merely pass through EU territory as part of a customs transit procedure and are then exported on to Egypt by ship. In this case, the EUDR does not apply, as the goods are not physically and legally made available on the EU internal market. There is no placing on the market within the meaning of the Regulation. The cocoa beans are neither sold, processed, nor used or offered internally, but merely transported onwards.

This means:

- There is no obligation to conduct a due diligence review.

- A Due Diligence Statement (DDS) is not required.

- The proof requirements of the EUDR also no longer apply.

However, it is important that the requirements of the customs transit procedure are clearly met. As soon as the goods are temporarily stored in the EU, cleared or made accessible to the internal market in any form, for example through internal processing or offering to customers, the EUDR would apply in full.

EUDR applies to placing on the market - not to pure transit

The EUDR always obliges companies when a product is physically and legally placed on the EU internal market for the first time, i.e. when it is placed on the market. It is irrelevant whether the product is subsequently sold, processed or exported. If a product is only transported through the EU, for example as part of a transit procedure, there is no EUDR obligation. The situation is different if it is stored in the EU, cleared through customs or further processed internally: the due diligence obligations then apply in full. A due diligence check is also required for intermediate solutions with downstream export as soon as the product has previously been made available on the domestic market.

Recommendations for companies

In view of the far-reaching definitions and obligations of the EUDR, a systematic and risk-based approach is recommended for companies in order to ensure legally compliant processes. This also makes sense, especially for self-consumption, self-import and special solutions.

Systematically analyze roles and products

Companies should check all imported and circulated raw materials for their EUDR relevance, regardless of their intended use. A role-based analysis is particularly recommended for complex groups of companies in which several legal entities, subsidiaries or permanent establishments are involved in the movement of goods. The key question here is always: When will the EUDR raw materials enter the EU market for the first time? And: Does this take place as part of a trade, an intra-group transfer or an alleged own use? Only a detailed mapping of all affected flows creates legal certainty and prevents sanctions. In this context, it is advisable to create procedural documentation that documents the risks and obligations along the entire value chain in the form of process manuals, flow charts or supplier audits.

DDS also for own use

A common mistake is the assumption that the due diligence obligations only apply to commercial sales. In fact, every product, regardless of its intended use, must undergo the DDS when it is first made available on the EU internal market. This applies in particular to products that are only used or processed internally after import. Companies should check at an early stage whether their procurement, internal processing or supply to closed user groups falls within the scope of the EUDR. In addition to the formal creation of a DDS, this also includes the establishment of processes for supplier verification, risk analysis and verification management. Industry-specific software and templates can reduce the effort involved and enable standardized implementation.

Communication, information and verification

Clear communication about EUDR-compliant processes and obligations is crucial for both external partners and internal stakeholders. Companies should involve purchasing, logistics, production, facility management and internal service providers in the documentation and compliance processes in good time. Securing evidence is becoming more legally relevant due to the potential fines under the EUDR. It is advisable to archive all relevant process steps, decisions and checks electronically in an audit-proof manner and to monitor them regularly through internal audits. An unexpected risk arises, particularly in the case of in-house consumption, as many highly qualified employees are not familiar with the documentation requirements of the EUDR. Finally, open communication with business partners, suppliers and relevant authorities is a must. This is the only way to avoid compliance pitfalls and ensure sustainable, trustworthy supply chain management.

Conclusion and outlook

The example of in-house consumption, in-house imports and intermediate solutions shows that the EUDR goes much further than many companies assume. It not only affects wholesalers or traditional importers, but also companies that use raw materials such as cocoa, coffee, wood, palm oil or rubber exclusively for internal use or in special projects. Anyone who imports such materials from non-EU countries and uses them for the first time within the EU is generally subject to EUDR obligations, even if they are not resold. Decentralized company structures, complex supply chains or cross-company processes are particularly risky. Legal loopholes can quickly arise here if due diligence obligations are not clearly regulated. Companies should therefore carefully review their internal processes and flows of goods, define clear responsibilities and offer regular training for employees. Digital and complete documentation is also crucial in order to be able to provide reliable evidence in the event of an inspection. Those who take a structured approach to EUDR at an early stage not only reduce legal risks, but also strengthen their competitiveness and make an active contribution to the sustainable design of global supply chains.

FAQ

The EUDR applies when a product is imported from a non-EU country. If the goods are purchased from the EU for own use, companies are deemed to be non-commercializers. They are therefore not subject to EUDR.

The EUDR applies to raw materials as well as to intermediate and end products made from them, provided they contain the listed materials and are made available on the EU market for the first time. Internal production steps that lead to new products can also be classified as placing on the market within the meaning of the EUDR.

The EUDR obligations only apply to imports from non-EU countries. The purchase of a product within the EU is not subject to EUDR if it has already been placed on the market and a valid DDS is available.

Yes, such uses are also considered captive use and trigger EUDR obligations when the raw materials concerned are imported into the EU for the first time.

If products are first processed or temporarily stored after import before they are exported, this constitutes placing on the market within the meaning of the EUDR, with a corresponding duty of care.

A product is considered to have been placed on the market as soon as it physically and legally enters the EU internal market. This can take place, for example, through storage, clearance or supply on the market. However, mere transit through the EU does not trigger an EUDR obligation.

They do not differ. The same requirements for due diligence, documentation and submission of a DDS also apply to self-import as to import for resale.

As long as it is not a new first placing on the market (e.g. by processing into a new product), downstream movements within the EU are not subject to EUDR. Provided that the original DDS is available.