EUDR and the importance of HS and TARIC codes - What companies need to know now

EUDR - Reading time: 7 Min

The EU Deforestation Regulation (EUDR) has a significant impact on international trade and supply chains. For companies that import or export products, the correct classification and declaration of goods is essential. The Harmonized System (HS) codes of the World Customs Organization and the TARIC codes play a key role here. These codes not only determine the tax and customs status of goods, but are also largely responsible for compliance with EUDR regulations. An incorrect declaration can have far-reaching consequences, including legal sanctions and delays in the delivery process. Why is the correct classification of goods central to the EUDR? The EUDR aims to counteract deforestation and the associated environmental degradation. Companies are required to be transparent in the sourcing and trading of goods to ensure that they do not contribute to deforestation. Accurate classification of goods through HS and TARIC codes is crucial as it forms the basis for traceability and reporting. These codes help to determine the origin and environmental footprint of products, which in turn ensures compliance with the EUDR. This article provides a comprehensive overview of the importance of HS and TARIC codes in the context of the EUDR. Companies should use this information to better understand the role of goods classification in meeting legal requirements. The functions of the codes are explained and practical tips on correct classification are provided. The aim is to enable companies to optimize their compliance measures and thus assume their responsibility towards the environment.

The most important facts

The six-digit HS code is a globally used system for classifying goods in international trade.

The TARIC code is an EU-specific extension of the HS code, which can comprise up to ten digits.

The EUDR uses HS and TARIC codes to identify the goods concerned and to ensure due diligence.

The EZT-Online and TARIC platforms are central points of contact.

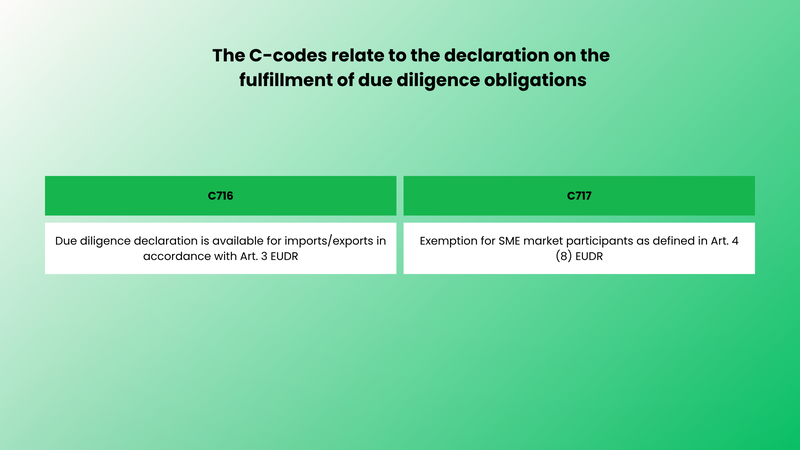

C716 indicates that a due diligence declaration exists. C717 applies to SME market participants that are exempt from due diligence under certain circumstances.

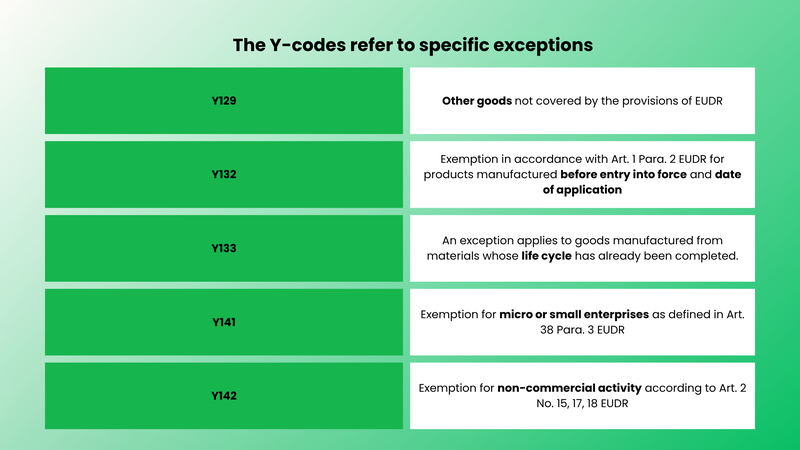

Y-codes provide specific information on exceptions.

The precise classification of goods using HS and TARIC codes is crucial to ensure smooth import and export.

Executive Summary

The Harmonized System (HS Code) is a globally recognized system for classifying goods in international trade. It consists of six digits and forms the basis for the tariff classification of products. Customs authorities use the HS code to calculate duties and taxes. The EU Regulation on the Prevention of Deforestation through Business Practices (EUDR) integrates the HS Code to identify affected goods and their due diligence requirements.

The TARIC code (Integrated Tariff of the European Communities) is an EU-specific extension of the HS code. It can comprise up to ten digits and takes into account additional EU measures such as customs duties and import restrictions. EU customs authorities use the TARIC code to define customs regulations and import rules. The EUDR uses the TARIC code to define which goods are subject to due diligence.

The relationship between EUDR, HS and TARIC codes is central. While the HS code is responsible for global classification, the TARIC code covers EU-specific aspects. The combination of both codes ensures that goods are subject to due diligence and are deforestation-free.

An example of this process is the import of a specific wood product into the EU. The HS code classifies the wood product, such as "wood, charcoal", while the TARIC code defines customs duties, import restrictions and due diligence according to EUDR.

Companies can find the relevant codes on the respective platforms. The HS code can be determined via EZT-Online, the official platform of German customs for the tariff classification of goods. The TARIC codes are available in the EU Customs Tariff Database (TARIC) on the European Commission's website. The EUDR Regulation also contains information on the relevant HS and TARIC codes.

What is the difference between HS codes and TARIC codes?

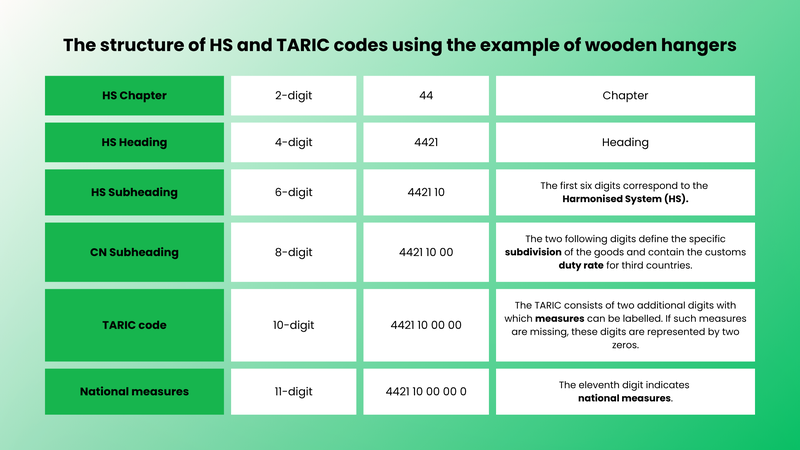

The HS Code, or Harmonized Commodity Description and Coding System, forms the basis for international trade classification. This six-digit code is used worldwide to systematically classify goods and facilitate trade between different countries. The structure of the HS code follows an internationally recognized scheme, which enables a standardized classification and thus ensures transparency and uniformity in global trade. Exports require an extension to eight digits (combined nomenclature), while imports require up to ten or sometimes eleven digits (customs tariff numbers and national characteristics).

It can be summarized that within the EU, the HS code is supplemented by two digits for the nomenclature. The ninth and tenth digits indicate the TARIC, which provides information on EU measures such as additional customs duties, while the eleventh digit describes national regulations such as bans or restrictions.

TARIC codes: A comprehensive overview

The legal basis for TARIC is Council Regulation (EEC) No. 2658/87 of July 23, 1987, which deals with the tariff and statistical nomenclature and the Common Customs Tariff (published in Official Journal L 256 of September 7, 1987).

The harmonization of specific EU requirements in the area of HS codes includes a variety of categories of measures covering both tariff and non-tariff aspects. These measures are designed to ensure that import and export processes comply with strict EU directives in order to promote free and secure trade within and outside the EU.

Tariff measures include third country tariffs that apply to imports originating outside the EU and are defined in the Combined Nomenclature. Tariff preferences grant trade advantages to certain countries, while autonomous tariff suspensions temporarily suspend the levying of customs duties on selected goods. Tariff quotas, which provide a quantitative limit on duty-free or reduced imports, and customs unions, which promote duty-free trade within the Union without internal tariffs, also play an important role.

In the area of agricultural policy, specific measures such as agricultural components and additional duties on the sugar content of goods are important. Representative prices for poultry and flat-rate import values and unit prices for fruit and vegetables also regulate the market.

Trade policy measures include anti-dumping and countervailing duties, which help to create fair market conditions. Safeguard measures include import and export bans on certain goods, such as ozone-depleting substances or goods from and to certain countries such as Iran and North Korea. Quantitative restrictions and the control of imports and exports of goods, including CITES goods (species-protected goods), luxury goods and dual-use goods (products that can be used for both civilian and military purposes), ensure compliance with internationally agreed standards. Veterinary and phytosanitary controls (plant health controls) also ensure the safety of animals and food.

The monitoring of imports and exports ensures compliance with the legal bases and thus ensures the proper functioning of EU trade mechanisms. These specific requirements for HS codes are an integral part of EU trade policy, which aims to ensure integrity, sustainability and security in international trade.

The structure of HS and TARIC codes using the example of hangers

A comparison using the example of wooden clothes hangers illustrates the practical use of these codes. The HS code can provide general information about the product group, while the TARIC code provides specific customs duties or trade-related requirements for imports into the EU. Together, these codes therefore function as a comprehensive system for increasing efficiency and regulating international trade activities.

The 11-digit code number must always be stated in an import declaration, while only the 8-digit goods number must be stated in the export declaration.

The determination of HS and TARIC codes in the EUDR - why they are so important

The Harmonized System Codes (HS codes) and the TARIC (Integrated Tariff of the European Communities) play a decisive role in the implementation of the EU Regulation on the prevention of deforestation (EUDR). These codes serve as a basis for the clear identification of product groups that could be affected by the regulation.

The C-codes relate to the declaration on the fulfillment of due diligence obligations

However, when products covered by the EUDR are imported or exported, it is not immediately possible to determine whether or not they are covered by a due diligence declaration on the basis of the existing TARIC alone.

For this reason, the EU Commission has published new TARIC codes in connection with the EUDR, which enable customs to quickly identify whether a relevant product meets the requirements of the EUDR or not: the TARIC document code C716 is important. This indicates that a due diligence declaration is available and that the product may be put into circulation. In practice, this means that if a due diligence declaration is available for the goods in question, the TARIC code C716 must be indicated on the customs declaration in addition to the full customs tariff number from the date of application of the regulation. When creating the customs declaration, specific entry fields are provided for each of this information, including any additional information such as the description of the goods.

Furthermore, a new TARIC code C717 is introduced, which is relevant for SME market participants that are exempt from due diligence under Article 4(8) EUDR. In other words, affected SMEs do not have to assume due diligence obligations for already declared relevant products that already comply with the due diligence obligation and for which a due diligence declaration is available. This code must be provided to customs if companies are not required to carry out due diligence on products that are already subject to declaration and for which a due diligence declaration is available. C717 serves as a reference number for the previously submitted due diligence declaration.

The Y-codes refer to specific exceptions

Y-codes provide specific information on exemptions that are particularly important for small and medium-sized enterprises (SMEs). They also include relevant regulations for goods manufactured from materials whose life cycle has already been completed.

A new TARIC code Y129 has been introduced for the "ex" codes in Annex I of the EUDR. The code refers to the declaration of goods that do not fall within the scope of the Regulation, so-called "ex" products. In such a scenario, it is necessary for the declarant to be able to indicate that the Regulation does not apply to the import, even if the declared product is assigned to a nomenclature code covered by the EUDR. To clarify: The "ex" in front of the tariff code identifies a product as an extract from a group of products with identical numbers. For example, the tariff code 9401 refers to seating furniture, including furniture made of different materials, but only furniture made of wood is subject to the specific requirements of the regulation.

The TARIC code Y132 refers specifically to Art. 1 para. 2 EUDR. This states that the provisions of the EUDR do not apply to the relevant products listed in Annex I if they were manufactured before the date specified in Art. 38 (1) EUDR, i.e. before the period of validity of the EUDR.

TARIC code Y133 defines an exemption in accordance with the second paragraph of Annex I of the EUDR, according to which the Regulation does not apply to goods made entirely of materials whose life cycle has been completed. These products are considered recycled.

The TARIC code Y141 is used for the exemption defined in Art. 38 para. 3 EUDR for market participants that were considered micro or small enterprises in accordance with Directive 2013/34/EU as of December 31, 2020. These market participants must comply with the provisions of Art. 38 para. 2 EUDR from June 30, 2025. The TARIC document code must therefore only be provided to customs until June 29, 2025.

In addition, the TARIC code Y142 was introduced, which applies to customs declarations in connection with non-commercial activities. In this respect, this code refers to the definitions mentioned in Art. 2 No. 15, 17, 18 EUDR.

The Combined Nomenclature (CN) and TARIC are seamlessly integrated into the EUDR to ensure a clear classification of products that may contribute to deforestation. This codification not only facilitates the administrative process, but is also an indispensable tool for companies engaged in international trade. With its help, companies can precisely determine whether their goods meet the requirements of the regulation and what regulatory steps are required to ensure compliance.

These codes play a central role in risk analysis and the preparation of due diligence declarations. By precisely categorizing products, companies are able to more effectively identify potential risks in their supply chains and implement appropriate risk mitigation measures. The ability to successfully identify and apply the relevant codes for their products is therefore an essential part of the strategic planning and implementation of EUDR compliance.

Reporting obligation for raw materials and end products - what applies when?

The reporting obligation for raw materials and end products is a key aspect of the EUDR (EU Deforestation Regulation), which obliges companies to comply with specific due diligence obligations. Above all, the question arises: if a raw material is affected by the regulation, does this automatically apply to the resulting end product? The answer is complex and depends on various factors.

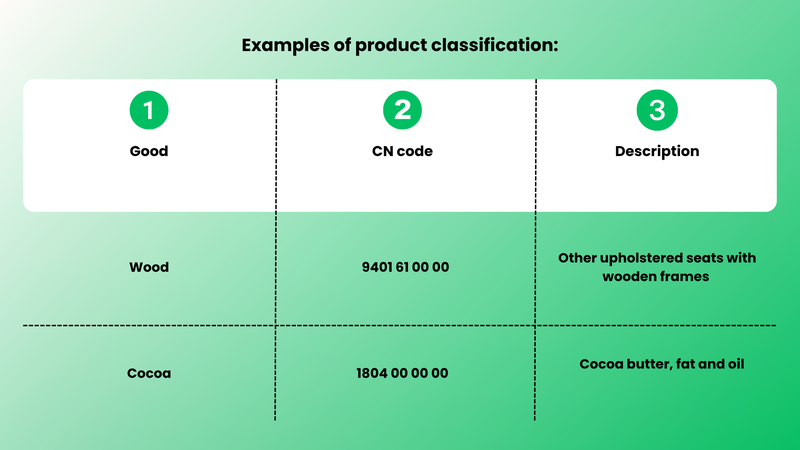

An end product becomes EUDR-relevant if it fulfills certain criteria. These include the CN heading, the level of processing and the ex designation of the product. The CN heading, also known as the Combined Nomenclature, is an important factor as it regulates the classification of goods in international trade and helps to determine the regulatory requirements. The level of processing and the ex designation also provide information on the extent to which a product is affected by regulation.

Examples of product classifications are helpful to illustrate this.

Step by step

Step 1: Inspection of Annex I of the EUDR

✔️ The table in Annex I lists the goods according to their classification in the Combined Nomenclature.

Step 2: Determining the CN position

✔️ Determine the CN heading for the goods concerned on TARIC. For example, Chapter 44 concerns wood and wood products.

Step 3: Check Annex I for ex-code in the corresponding category

✔️ Check Annex I for relevant raw material and relevant products. The ex codes must be observed. Example: Tariff code ex9401 includes seating furniture made of different materials, whereby only the wood products are subject to the specific requirements of the EUDR.

Practical implementation for companies

Companies involved in international trade face the challenge of using correct and up-to-date HS (Harmonized System) and TARIC (Integrated Tariff of the European Communities) codes. Accurate classification of goods is essential to fulfill customs obligations and avoid potential legal risks. Regularly checking and updating these codes within the company is therefore of great importance.

Cooperation between the customs department, purchasing and product management plays a central role here. An effective internal exchange ensures that all relevant departments are always up to date and work together on the correct classification of goods. This not only prevents delays in the operational process, but also promotes compliance with legal regulations.

In order to manage the complexity of tariff classification effectively, companies should ensure that their goods are classified correctly. The use of practical instructions and digital aids such as the EU customs tariff database (TARIC) and EZT-Online is recommended for this purpose. These tools enable precise and efficient classification and help companies to achieve their compliance goals in the long term.

Conclusion & next steps

Commodity codes play a crucial role in the context of EUDR compliance (EU regulation on the prevention of deforestation), as they form the basis for accurate, traceable reporting and strict compliance with legal requirements. These codes are not just technical details; they are essential for transparency in supply chains and serve as a binding basis for meeting regulatory requirements. Companies are therefore well advised to proactively ensure the correct classification of their goods. Careful classification is the only way to effectively contain potential regulatory risks and avoid import and export bans.

In order to best meet the challenges of EUDR compliance, the next step is to implement a structured process for regularly checking and updating the goods codes. This process should not only be thorough, but also systematic to ensure a high level of accuracy.

It is also advisable to establish a suitable documentation system. This system should comprehensively and comprehensibly record all changes in order to enable transparent reporting. Clear documentation not only facilitates internal audits, but also promotes traceability and decision-making within the company.

FAQ

The HS code (Harmonized System) is an international classification method with six digits that is used worldwide for the systematic classification of goods. Within the EU, two digits are added to the Combined Nomenclature (eight digits). The TARIC code adds two further digits to reflect EU-specific trade protection measures such as customs duties or restrictions. An eleventh digit can include national special features or regulations.

The HS and TARIC codes are crucial for the implementation of the EU Regulation on the Prevention of Deforestation (EUDR) as they identify the product groups covered by the regulation. New TARIC codes such as C716 and C717 help to monitor compliance with due diligence obligations and ensure that affected products meet the EUDR requirements.

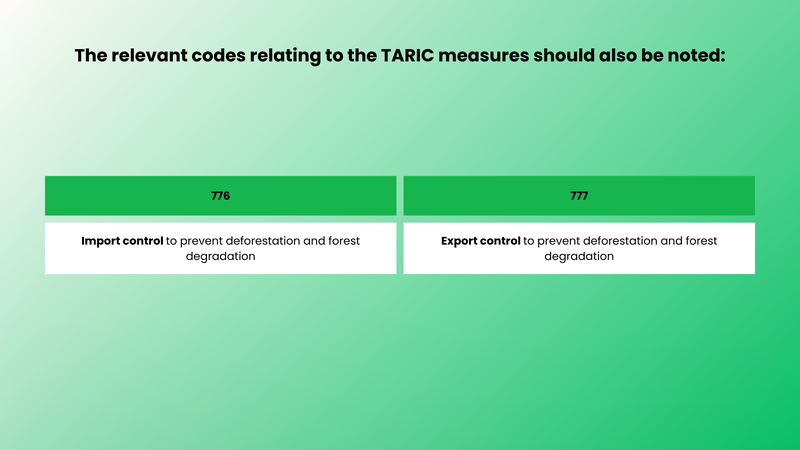

The TARIC code is crucial for import control, as it indicates specific measures such as customs duties and import restrictions. Codes 776 and 777 in the TARIC system are relevant, for example, for import and export controls to prevent deforestation and forest degradation.

C-codes in the TARIC system are relevant for the due diligence declaration of products, while Y-codes document specific exceptions, such as for recycled goods or special SME regulations. These codes help companies and customs authorities to act in accordance with EU regulations and ensure compliance.

The obligation to declare depends on the classification of the products according to the Combined Nomenclature (CN). Raw materials and the resulting end products are subject to EUDR if they meet the specific criteria of the regulation, which relate to the CN heading, the depth of processing and the ex designation. Companies must check the relevant product specifications to ensure their EUDR compliance.

Companies should regularly review and update their commodity codes to comply with customs requirements and minimize legal risks. Close cooperation between the customs department, purchasing and product management is crucial. Tools such as the EU Customs Tariff Database (TARIC) and EZT-Online can assist with correct classification and facilitate compliance with EUDR.

The correct use of commodity codes is essential for EUDR compliance. Companies should proactively implement structured processes to regularly review and update classifications. In addition, a comprehensive documentation system promotes transparency and traceability, which is helpful in meeting regulatory requirements. Companies should ensure that their internal systems and processes are regularly reviewed and adapted to new regulatory requirements.