EUDR and the "cut-off date": How to deal with goods in stock and later placing on the market?

EUDR - Reading time: 8 Min

With the EU regulation on deforestation-free supply chains (EUDR) coming into force, logistics, production planning and stock levels are coming under greater scrutiny. The deadline raises key questions, particularly for companies with goods in stock. The cut-off date defines the date from which certain products may only be placed on the market if due diligence obligations have been met. Many of the products concerned were manufactured long before this date. The aim of this article is to explain the legal requirements of the EUDR with regard to the cut-off date, to highlight the challenges of keeping records and stock levels and to provide practical recommendations for action.

The most important information at a glance

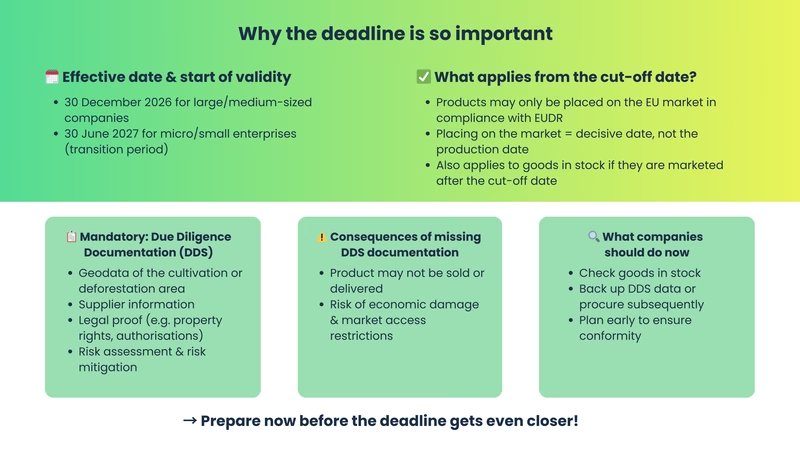

From December 30, 2026 (or June 30, 2027 for SMEs), affected products may only be placed on the EU market with complete DDS documentation.

Yes - all products that are made available in the EU for the first time after the deadline must be EUDR-compliant, regardless of the production date.

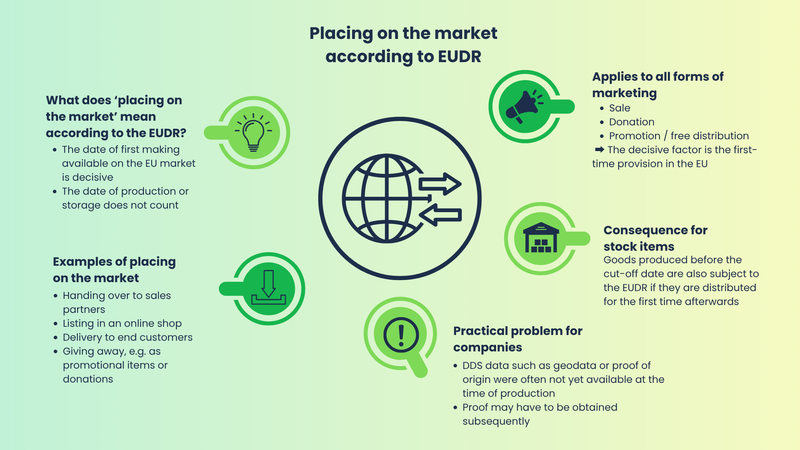

Any first-time provision on the EU market - whether sale, donation, listing in the store or advertising gift.

Yes - but the complete documentation must be available at the latest when the product is placed on the market.

Fines, recall obligations and market bans if products are sold or distributed without a complete EUDR-DDS.

Executive Summary

The EU regulation on deforestation-free supply chains (EUDR) will present companies with new challenges from December 30, 2026 (or from June 30, 2027 for micro and small enterprises), including when dealing with goods in stock. This is because the decisive factor for the application of the EUDR is not the time of production, but the moment of placing on the market. This means that products that are produced before the deadline but only made available on the EU market afterwards must also be fully EUDR-compliant. This includes complete DDS documentation with proof of legal origin, freedom from deforestation and risk assessment of the supply chain. It is therefore essential for companies to check all stocks at an early stage and identify critical products for which complete documentation is not yet available. The data can therefore be collected and supplemented retrospectively as long as due diligence is complete before the product is placed on the market. This requires functioning processes, clear responsibilities, coordinated supplier communication and reliable systems for data collection and storage. Companies should now actively involve their suppliers in the documentation obligations, add EUDR-relevant clauses to existing contracts and expand internal compliance structures. Those who act too late or enter the implementation phase unprepared risk severe sanctions, economic losses and damage to their image. To avoid this, companies should start strategic planning now - and treat stock items just as proactively as future production batches.

Goods in stock and placing on the market: Why the cut-off date is crucial

With the entry into force of the EUDR, one term is gaining central importance: placing on the market. For many companies, this legal term is crucial when it comes to evaluating stock levels and correctly implementing the compliance requirements of the EUDR. Contrary to popular belief, it is not the production date of a product that is decisive, but the moment it is first made available on the EU market.

What does "placing on the market" mean within the meaning of the EUDR?

The EUDR defines placing on the market as the first making available of a product on the EU market. This includes any form of physical or digital market availability, such as selling to end customers or retailers, placing in a webshop, giving away as a promotional item or giving away free of charge as part of fundraising campaigns. The decisive factor is always the first market appearance within the EU, regardless of when production took place or how long a product was previously stored. This definition entails a key risk for companies: goods in stock that are produced before the deadline but only sold or delivered after the deadline are fully subject to the requirements of the EUDR. Whether it is wood panels, cocoa products or leather goods - as soon as such a product is made available in the European Economic Area for the first time after the cut-off date of December 30, 2026 (for micro and small enterprises generally from June 30, 2027 - exception: if they were already covered by the previous EU timber trade regulation, December 30, 2026 also applies), all EUDR obligations must be met.

Why does this affect stocks in particular?

Many companies have large quantities of pre-produced goods in stock whose origin is legal and sustainable, but for which there is no or only incomplete documentation within the meaning of the EUDR. In the past, it was often not necessary to document complete information on the supply chain, geodata on the origin of raw materials or risk assessments for each individual product. The EUDR fundamentally changes this: a DDS must be available for every relevant batch that is made available on the EU market for the first time after the deadline - to be submitted by the actor who places the goods on the EU market for the first time. As a rule, downstream companies must document and maintain the DDS reference number. This includes in particular

- Geographical origin of the raw materials (e.g. coordinates of the cultivation area, logging location)

- Legal proof of the legality of harvesting and production

- Supplier information along the entire chain

- Risk assessment and risk mitigation measures if necessary

Without this evidence, the products may no longer be placed on the market in compliance with the law. Not even if they were manufactured years ago.

Exemplary application: When old goods become a challenge

A company produces large quantities of furniture panels made from tropical wood in 2023 and stores them for seasonal marketing. In 2027, after the EUDR deadline of December 30, 2026, they are to be placed on the market. No comprehensive DDS data was collected at the time of production, as the new regulation was not yet in force. The coordinates of the areas of origin, chain-of-custody documents and legal proof of raw material extraction are now missing. The consequence: without this data, the furniture boards may not be sold or otherwise made available in the context of a commercial activity (even free of charge) as long as no valid DDS or DDS reference is available. This means a potentially high loss for the company - both financially and in terms of storage capacity, planning security and customer satisfaction. In addition, there are risks such as fines, recall obligations or even market closures if the regulations are disregarded.

What companies need to do now

The decisive lever lies in the timely and systematic review of all stock levels. Companies must identify at an early stage which products are likely to be placed on the market for the first time after the deadline and whether complete DDS data is already available for them. If information is missing, it should be requested in a targeted and timely manner. Ideally, this should be done in close cooperation with the suppliers. If retroactive documentation is not possible, alternative strategies should be examined, e.g:

- Rededication of goods for non-European markets

- Early sale before the deadline

- Targeted adaptation of the marketing strategy

The EUDR always considers products with regard to their first market entry, not their origin in the warehouse. This means that old goods must also be reassessed. Companies that underestimate this fact or act too late risk being stuck with unmarketable goods after the deadline - with corresponding legal and economic consequences.

Production planning and the EUDR obligation - what companies should consider

Challenge: No DDS data yet available for 2026 production

Many companies are faced with a major dilemma: for many products that are to be sold after the EUDR deadline, the necessary evidence is often not yet available at the time of manufacture. In practice, production and purchasing decisions are often made months in advance, long before it is clear exactly where the raw materials come from and whether the supply chain can be fully documented. Especially with long supply chains, international suppliers and fluctuating flows of goods, it is difficult to obtain all the necessary information retrospectively, for example about the exact origin of the raw materials or the geographical data of the cultivation or forestry areas. In some cases, this is no longer even possible. This means a high risk for companies: if the DDS documentation is not complete and available on time, the products may no longer be sold in the EU after the deadline in accordance with the law, even if they have been in the warehouse for a long time. Companies that purchase large quantities of stock goods or work with complex, international supply chains are particularly affected. It will be crucial for them to create transparency about their stocks at an early stage and close any gaps in their documentation before the EUDR deadline is reached.

Important: It is crucial that a valid DDS is available in the system before the initial distributor places the product on the market for the first time. As a rule, downstream companies must document and maintain the DDS reference number.

A practical example: When goods ordered on time suddenly become a risk

Let's imagine the following scenario: A retail company plans early for the coming season and orders a large quantity of products, such as wooden furniture or coffee products, as early as summer 2026. These are not to be advertised and sold until spring or summer 2027. The products are therefore produced and stored long before the official EUDR deadline. However, not all of the information required for EUDR documentation is available at the time of production and ordering. This includes, for example

- Geodata of the original areas (e.g. logging site or coffee farm)

- Chain-of-custody evidence, i.e. complete evidence along the supply chain

- as well as legal documents on the origin and legality of the raw materials

The problem is that even if the goods were ordered and produced on time, they are only placed on the market after the EUDR deadline, by which time all EUDR requirements already apply. As already mentioned, the products may no longer be sold without complete, seamless documentation. The missing data would therefore have to be obtained or reconstructed retrospectively in order to fulfill the due diligence obligations. This can be costly, time-critical or, in the worst case, impossible, for example if the original supplier is unable to provide sufficient evidence. As a result, the goods that have already been paid for and stored may not be marketed in accordance with the law - with possible financial and logistical consequences. This example shows how important it is to think about the EUDR requirements when ordering and planning production, even if the deadline is still in the future.

Room for maneuver in the regulation: add documentation retrospectively

The good news first: the EUDR gives companies a certain amount of leeway when it comes to fulfilling their obligation to provide evidence. The only decisive factor is that all the required information is available in full and correctly documented at the latest before the product is placed on the market. This means that if a product was already manufactured and stored in 2026 but is not to be placed on the EU market until 2027 after the EUDR deadline, the associated due diligence declaration can also be prepared retrospectively. It must be possible to clearly assign this information to the product, for example via batch numbers or digital assignments in the ERP system. It is important to note that all evidence must be complete and correct before the product is sold or otherwise made available as part of a commercial activity (including free of charge).

In practice, the company faces a number of challenges:

- Supplier communication: Information must be requested early and reliably, even retroactively for goods that have already been produced.

- Data management: Evidence must be centrally recorded, stored and retrievable at any time. Ideally, this can be handled digitally and with IT support.

- Internal processes: Purchasing, logistics and compliance must work closely together to ensure that no products are placed on the market without complete EUDR documentation.

It is therefore possible to obtain missing evidence retrospectively. However, this room for maneuver is only a real help if companies actively use it - with clear processes, good preparation and a reliable supply chain.

It should also be noted: According to Article 5 of Commission Implementing Regulation (EU) 2024/3084, the revocation or amendment of a transmitted due diligence declaration is only possible within 72 hours after the reference number has been made available in the information system. Revocation or amendment is not possible if the reference number has already been used in a customs declaration referred to in another due diligence declaration or if the product has already been placed or made available on the Union market.

Practical recommendations for action

Early identification of affected stocks

Companies should start taking a close look at their stock long before the EUDR deadline. This applies in particular to products that are not to be placed on the market until after the deadline. The aim is to recognize early on which stocks have no or only incomplete DDS data. Products for which the supply chain is not fully documented or important evidence, such as origin or geodata, is missing are particularly critical. It is not enough to just check the warehouse. Planned advertising campaigns, seasonal products or sales promotions should also be taken into account - in other words, everything that has already been produced but will only be marketed at a later date. In order to maintain an overview and fulfill all obligations on time, it is worth using special software. Solutions such as the EUDR module of the lawcode Suite or other DDS databases can help to systematically record and manage the necessary information and, in case of doubt, provide legally compliant evidence. The inventory check should also record who is the first distributor in the chain (DDS levy) and whether a valid DDS reference number is available for the goods concerned or can be obtained in good time.

Actively involve suppliers and obtain information

The EUDR duty of care can only be reliably fulfilled if the entire supply chain is involved, from the source of the raw materials to the company's own warehouse. Companies are in a good position if they involve their suppliers at an early stage and work together on the necessary documentation. This includes informing partner companies about the EUDR requirements and raising their awareness. At the same time, companies should ensure that there are clear and functioning communication channels. This is necessary, for example, to be able to request missing DDS data or proof of stock goods at a later date. Particularly in the case of complex or international supply chains, it makes sense to review existing contracts and add specific EUDR clauses. These clauses can stipulate that all important information must be provided in good time. It is also advisable to check all important suppliers for their EUDR suitability now. If it becomes apparent that certain partners will not be able to meet the requirements, alternative sources of supply should be sought at an early stage. Prioritize suppliers and articles according to country of origin risk category (country benchmarking). Simplified steps are possible for low-risk origins; for standard/high-risk origins, risk analysis and, if necessary, risk mitigation must be much more extensive.

Organize internal documentation

In order to implement EUDR-compliant DDS documentation for warehouse goods, various adjustments to internal processes are necessary depending on the company structure. It is particularly important to integrate an internal documentation system that clearly identifies the stock and assigns unique origin, legality and risk assessment data to each batch. It is necessary to establish workflows for both old stocks and future production. This is the only way to comprehensively document compliance with the EUDR retrospectively and prospectively from the cut-off date. In addition to geodata/legality, the documentation system should therefore also map DDS reference numbers and clearly regulate who in the chain must retain them.

Conclusion and outlook

Whether stock items are covered by the EUDR depends solely on the time at which a product is first placed on the Union (EU) market or made available as part of a commercial activity. Products that were manufactured before the start of use but are only made available on the EU market for the first time afterwards are fully covered by the regulation and require the corresponding proof. This protects goods that have already been placed on the market from retroactive requirements - but increases the pressure on companies to check their stocks and marketing plans in advance.

Clarifying roles in the supply chain is also crucial: the obligation to submit the due diligence declaration (DDS) is the responsibility of the initial distributor; downstream companies generally work with the DDS reference number and must document and maintain it. If you act too late, you run the risk of not being able to sell or import stock goods in a legally compliant manner after the start of application - with significant financial, legal and reputational consequences. This is why the integration of EUDR requirements into purchasing, supplier management, warehouse processes and sales - including reliable data/reference number handling - is becoming a mandatory strategic task for companies with complex supply and warehouse structures.

FAQ

The "EUDR effective date" (more precisely: start of application) is the date from which the obligations of the EUDR apply in practice. From then on, relevant products may only be placed on the Union market (EU) for the first time or made available as part of a commercial activity if the EUDR requirements are met. For stock items, this means that it is not the production date that counts, but the date of first placing on the market/provision after the start of use. Timetable: Large and medium-sized market participants from 30.12.2026, micro/small in principle from 30.06.2027 (with the exception of certain micro/small that were already covered by the previous EU timber regulation: 30.12.2026).

Yes, it is crucial that all the necessary information is available in full before the first placing on the market/provision. In practical terms, this means that evidence (e.g. geodata, legality documents, supply chain data) can be procured and assigned retrospectively for stock goods that have already been produced - as long as this is done in good time before the first market entry in the EU.

In principle, yes, if the supply is made as part of a commercial activity (e.g. promotional items, marketing campaigns, customer loyalty measures) - the EUDR also covers "provision" free of charge. In the case of purely non-commercial levies, the distinction in the individual case is decisive; in practice, the following usually applies to corporate levies: commercial activity → EUDR-relevant.

Depending on national implementation, violations may result in severe sanctions. The EU framework provides for fines of up to 4% of the EU-wide annual turnover, confiscation of products/proceeds and temporary exclusion from public procurement procedures; in addition, official measures such as market bans/withdrawal from the market may be considered.

- Check stocks & marketing plans at an early stage: Which goods are likely to be made available for the first time after the start of application?

- Clarify roles: Who is the first distributor (must submit DDS in the EU system)? Who is downstream (usually works with DDS reference numbers)?

- Supplier management: Request geodata, legality and supply chain data at an early stage; secure contractually.

- Data/process system: Batch allocation, proof archiving and DDS references mapped in an audit-proof manner (ERP/traceability/compliance tools).